War & Debt Won't Disappear - Secure Your Future with Gold

With Trump back in office, the nation faces a world on the brink of WWIII, where adversaries may risk nuclear conflict to push their agendas. America confronts a deepening global divide and a towering national debt with no quick solutions. As the U.S. grapples with an increasingly unstable world and unprecedented financial burdens, Americans remain vulnerable to economic shocks from volatile global forces.

Gold Will Inevitably Rise - We Face a World on Fire and a Heavy U.S. Debt Burden - Neither of Which Can Be Resolved Quickly

The World is Teetering on the Brink of World War III. The stakes are high, and the danger is real. This situation cannot be swiftly undone, and we may not have the luxury of time to bridge the deep divide

If The U.S. Enters WWIII, Gold is The Money That Holds Value

For thousands of years, paper currencies have collapsed for two primary reasons: war or excessive money printing.

In particular, countries print money extensively during recessions, financial crises, and wars to fund their efforts, leading to sharp declines in currency value. When a nation loses, it risks losing both its sovereignty and its financial system.

A clear illustration of this occurred during the U.S. Civil War. The Confederate dollar collapsed due to overprinting, lack of gold or silver backing, and the erosion of confidence as the South neared defeat. At the same time, the Union’s issuance of "greenbacks" to fund its war effort caused inflation and devalued its currency. Both sides suffered from the consequences of excessive money printing, though the Confederacy ultimately lost both its freedom and its currency.

In both World Wars, the U.S. dollar also lost value due to increased money printing to fund military operations, particularly during World War I, when inflation surged, and World War II, when the U.S. debt skyrocketed, weakening the dollar's purchasing power.

This is why governments and central banks hold vast reserves of physical gold, as trust between countries is fragile and complicated.

Gold is reccomended as an effective hedge for war. In addition to the paper currency losing value during times of war, governments often renege on their paper debts, either by failing to pay, restructuring them into nothing, or inflating the value away. In conflict of war or during civil unrest, silver and gold can be used to meet needs, and those who hold gold after the combat is over retain real wealth.

Governments Understand Gold’s Power

Israel just announced that they are strongly considering restricting how much gold and silver the public can purchase… This is telling!

Why? The citizens, concerned about the weakening value of their national currency and the possiblity of WWIII, are rushing to exchange their paper money for gold and silver—physical assets that governments cannot devalue or inflate away.

Governments understand this better than anyone, which is why they store so much gold, and why they may seek to limit the public from purchasing during times of crisis. As geopolitical uncertainties grow, more people seek the safety of gold and silver, knowing that these assets are real money and cannot be printed out of thin air or deleted with a button, unlike paper or digital currencies.

Gold Mitigates Risk from Unprecedented National Debt & Money Printing

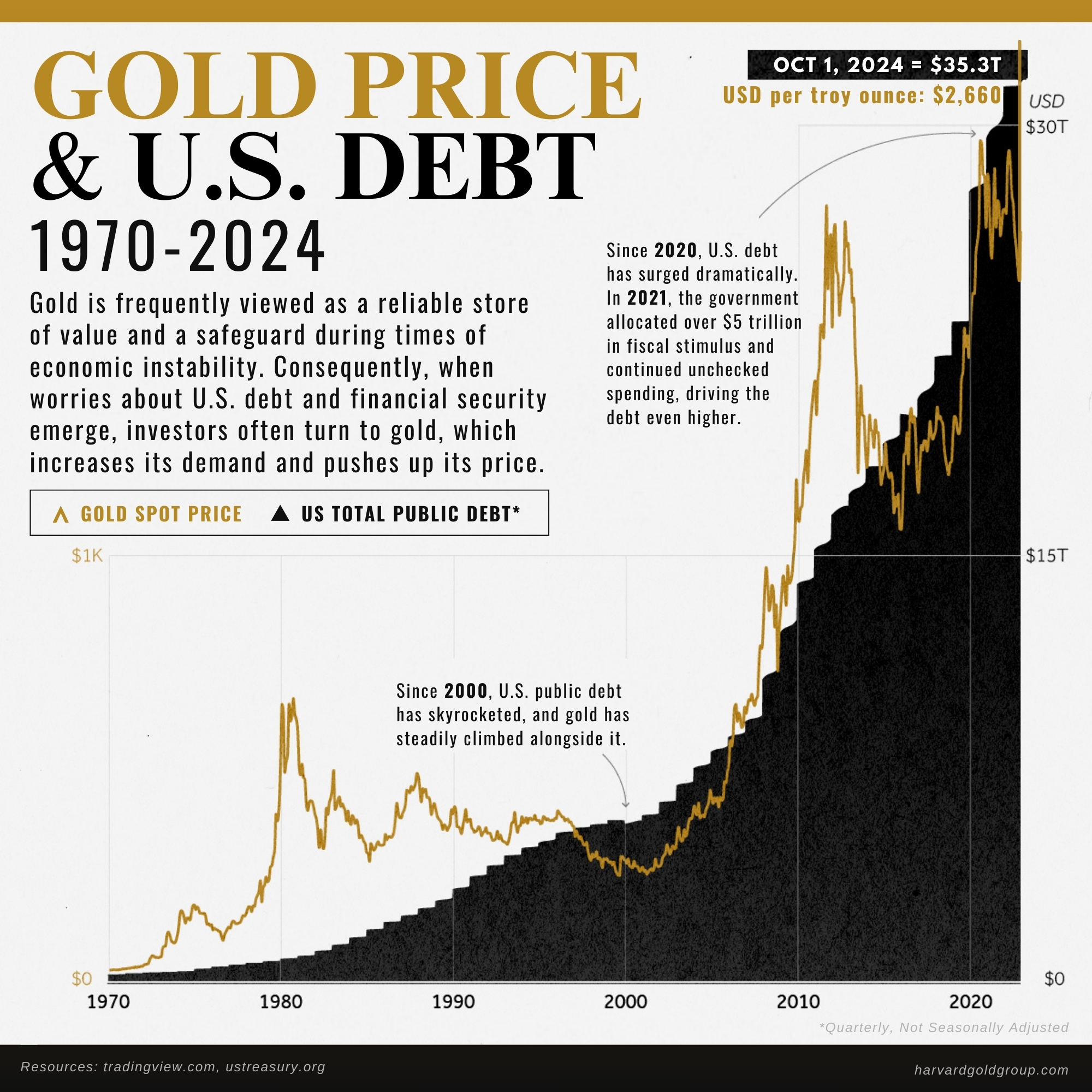

The graph clearly shows how gold responds to U.S. debt, proving to be an exceptional hedge.

Two More Reasons to Hedge with Gold Regardless of Who is in the White House: Eventual Recession/Financial Crisis & CBDCs

1. Massive Market Bubbles of Epic Proportions: Recession or Worse Will Come to Roost

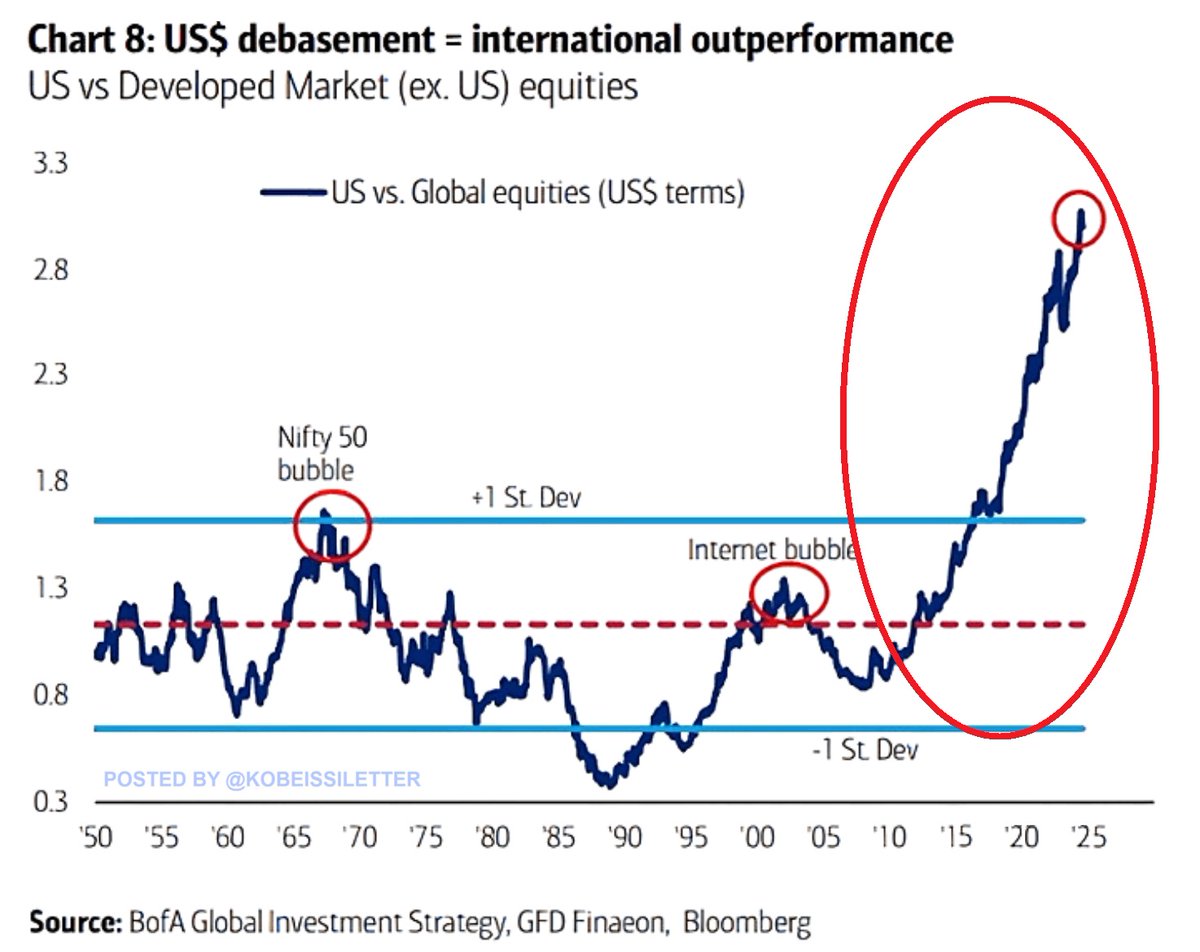

The U.S. stock market is enormous (see chart below). The ratio of U.S. stocks to developed market equities recently reached a record high of approximately 3.0x. Over the past decade, this ratio has doubled as U.S. stocks are extremely overvalued compared to their global counterparts.

Diversifying into physical gold is not just a smart strategy—it's a critical hedge against the volatility of stocks, bonds, and real estate. Gold has a proven track record of securing long-term financial stability, especially during times of economic upheaval. In the 2008 Great Recession, while many Americans saw their 401ks dwindle to "201ks" and home values drop by 20-30%, gold surged, gaining 51% in value between December 2008 and December 2009. This underscores the risks of relying solely on traditional paper assets.

Most Americans are unaware of how well physical gold has performed. Over the past 24 years, the U.S. has experienced significant growth in the economy and stock markets, as well as enduring three major crises: in 2001, 2008, and the 2020 COVID-19 pandemic. What is often overlooked is that physical gold over the long term has consistently outperformed the broader stock and bond markets. As of Spring 2024, gold has appreciated by more than 700% since January 3rd, 2000. By incorporating tangible gold into your portfolio, you can strengthen your ability to safeguard and grow your wealth in both favorable and challenging economic times.

2. Trump Has Power for Four Years: U.S. Central Bank Digital Currency (CBDC) is Inevitable

As the world increasingly moves toward digital currencies, governments will have greater control over money than ever before. Trump issued an order in January 2025 to prevent the U.S. from creating its own CBDC, but that order is likely to be overturned in as little as four years. Currently other countries are quickly developing Central Bank Digital Currencies (CBDCs) that will give central banks unprecedented power to monitor and control financial transactions. While these currencies may offer convenience, they also present dangers, including government surveillance and the erosion of financial privacy.

Unlike gold, which is tangible, CBDCs are fully digital, making them susceptible to manipulation, inflation, and government control. With the click of a button, governments could limit access to your funds or track every purchase. By contrast, physical gold and silver remain outside the reach of central banks, providing an important hedge against this growing financial centralization.

Physical gold and silver are the only truly private money and the best counter to eventual Centralized Digital Currencies, which could pave the way for a One World Currency and Government. As this new order of control emerges, people will move to gold in stampedes to maintain some financial privacy and wealth outside of government manipulation.

While you can't control if or when the world enters WWIII or when the U.S. government introduces new economic policies with digital currencies, you can protect your wealth by diversifying into physical gold and silver. These precious metals have stood the test of time and offer a stable, reliable way to preserve wealth in an age of uncertainty.

As Israel's recent actions show, when confidence in national currencies declines, people naturally turn to gold—and for good reason.

Physical gold is the only truly private money and the best counter to eventual Centralized Digital Currencies, which could pave the way for a One World Currency and Government. As this new order of control emerges, people will gradually lose more privacy.

This is for informational purposes and not to be taken as financial or tax advice.

Ready to Hedge with Gold?

Call America’s #1 Conservative & Christian Gold Co to Buy Your Physical Metals Today!

Why Harvard Gold Group?

Harvard Gold Group is America's #1 Conservative Gold Company

As seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The Christian Post, The New York Sun, and more. Exceptional customer service and value are the top priorities of Harvard Gold Group (HGG).

HGG is BBB A+, holds 5-star ratings across the board, and provides free consultations and metals overviews. We offer tax-free purchases, free 2-day shipping, the best pricing, and direct access to our co-owners, who have over 16 years of experience specializing in precious metals, moving over $100 million into tangible assets for people's IRAs/retirement accounts and for direct delivery. Customers enjoy lifetime account care and a straightforward buyback program without hassle or liquidation fees.

✔ Tax-Free & Penalty-Free: A Rollover or Transfer of your Retirement Account is almost always tax-free and penalty-free.

✔ Free Metals/Promos: Earn up to $15,000 in FREE Gold/Silver/Promos, on qualifying purchases.

✔ Free Retirement Account Rollover/Transfer: Zero cost to rollover/transfer/move retirement accounts or IRAs to a Gold/Silver IRA. *You can also earn up to 10 years of Precious Metals IRA yearly maintenance fees*.

✔ Privacy: We protect your privacy and believe it is a commodity as valuable as time, you can't get it back. We do not sell your information to third parties.

✔ HGG Lifetime Account Care: Providing a dedicated account specialist and keeping you updated with market news and trends.

✔ Harvard BuyBack Program: Hassle-free buyback of HGG metals with no liquidation fees.

✔ Guaranteed Precious Metals: We only deal in government-issued coins and branded bars.

✔ Free Shipping: Your precious metals are shipped privately and fully insured to the location of your choice. You can opt to have them delivered directly to your home, business, or an independent depository.

✔ Lowest Pricing: We are committed to offering you the best value possible, with a comprehensive price-match policy.

✔ Customer Satisfaction Guarantee: Harvard Gold Group is a 5-star rated company committed to maintaining exceptional customer service satisfaction.

✔ You work directly with the founders of HGG.