- The BRICS formal invitation of Argentina, Egypt, Ethiopia, Iran, the United Arab Emirates, and Saudi Arabia to join the bloc moves the world a step closer to a "very dangerous phase" for the U.S. and the next major conflict, according to Willem Middelkoop, ...

- “They are building a very powerful anti-western alliance, and it's more an anti-dollar alliance.

- The finance ministers and central banks of the BRICS members received instructions to look at a common currency ...

- Gold is very likely to play a key role in the new system because of how much gold is owned by central banks around the world.

- Even the Dutch central bank president has said that the Dutch still have a lot of gold because you need gold to restart the system when something goes wrong.”

- Who will start to back its currency with gold first?

- … "So expect gold to move to $10,000.”

- The revaluation of gold in this big monetary reset is just a matter of time, according to Middelkoop.

THE REVALUATION OF GOLD IN THIS BIG MONETARY RESET IS JUST A MATTER OF TIME, ACCORDING TO MIDDELKOOP.

(Kitco News) The BRICS formal invitation of Argentina, Egypt, Ethiopia, Iran, the United Arab Emirates, and Saudi Arabia to join the bloc moves the world a step closer to a "very dangerous phase" for the U.S. and the next major conflict, according to Willem Middelkoop, Founder and CIO of the Commodity Discovery Fund.

"I don't feel comfortable by all these developments, and we shouldn't call it World War III right away, but we're moving towards a very dangerous phase," Middelkoop told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News. "This BRICS conference is the next step in a financial economic war. And I'm afraid it's all connected, and I'm not the only one who has warned of a possible World War III scenario."

The new BRICS memberships will take effect from January 1, 2024. However, out of the six new members, Saudi Arabia is yet to officially confirm, with the country’s Foreign Minister Prince Faisal bin Farhan stating, “We await further details” and “based on this information and in accordance with our internal procedures, we will make the appropriate decision.”

Middelkoop responded that he was not surprised by Saudi’s messaging. “The Saudis have the petrodollar deal with the U.S. since 1974, so they have to play both sides,” he said.

Middelkoop referred to the deal between the Nixon administration and Saudi Arabia in the 1970s, which saw Saudis trade oil exclusively in dollars in exchange for security guarantees from the U.S.

The fact that Saudi Arabia agreed to have been named in the BRICS statement “is a sign there have been very serious talks between the BRICS alliance and the Saudis,” he added.

The next big risk facing the world is a war between the U.S. and China, Middelkoop pointed out.

"The biggest risk for all of us nowadays is that this fight between the U.S. and China might become kinetic one day," he said. "The world is getting less stable."

China has already foreseen that the BRICS alliance would be "very dangerous” to the U.S. To find out what steps China has been taking to prepare for a potential conflict with the West, watch the video above.

Looking at the numbers: What does the BRICS expansion mean?

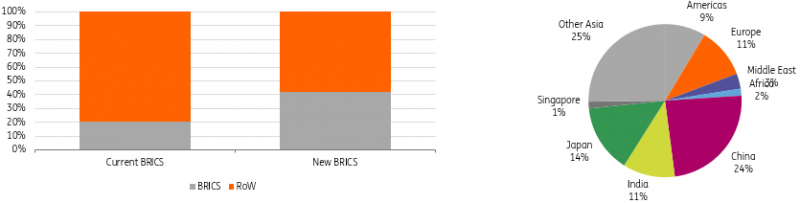

BRICS — Brazil, Russia, India, China and South Africa — represent 42% of the global population, 30% of the world’s land territory, 26% of global GDP, and 18% of global trade, according to the World Bank.

With six new members joining its ranks, that would increase to 46% of global population, 29% of global GDP, and 25% of global exports.

The most significant change will be noticed in the share of global oil production. Prior to the expansion, the BRICS were in control of around 20% of the global oil output. And after Saudi Arabia, UAE, and Iran join, the BRICS would account for at least 42% of global oil production, according to ING.

“They are building a very powerful anti-western alliance, and it's more an anti-dollar alliance. And I think there's a reason for the U.S. to get a bit worried. But this won't mean that the dollar will collapse within 12 months, but it all ... fits within this picture that we're living in the last phase of the international monetary system centered around the dollar,” Middelkoop noted.

What unites the BRICS countries?

Adding six more members means that the BRICS bloc will more than double. On top of that, more countries are waiting to join.

Prior to the summit in August, more than 40 countries expressed interest in joining the bloc, and 22 submitted formal requests. Others on the waiting list include countries like Kazakhstan, Algeria, Bolivia, and Indonesia.

“They're fed up with the Western double standards. They're fed up with the Western hypocrisy,” Middelkoop said. “These countries feel now united in their almost disgust of the Western system.”

Middelkoop sees major shifts happen within the larger system every 80 years. Watch the video above to get his reasoning and why it might be happening now.

BRICS common currency

This year’s BRICS summit highlighted that the next summit would focus on moving forward towards some form of common currency.

Following much speculation prior to the summit, the finance ministers and central banks of the BRICS members received instructions to look at a common currency and make this a priority for next year’s summit, which Russia is hosting in Kazan in October 2024.

Russia and Brazil have been the biggest proponents of the BRICS common currency that could be backed by commodities and rival the U.S. dollar.

"If this is the start of Bretton Woods III, if this is the start of a new monetary system centered around gold and commodities, that’s the most important topic of the last few decades,” Middelkoop said.

China will lead this effort, with Middelkoop describing the new currency as a settlement currency.

“The Chinese have studied the American playbook from the 1940s and 50s very well,” he said. “A few years from now, people will say we should have taken this whole development more seriously because it's the first time since the Soviet block that we had a united effort to really build something competitive to the Western system.”

Middelkoop pointed out that the world is in a de-globalization trend, with two possible scenarios at the end of the road. To find out what those two outcomes are and how likely things are to play out, watch the video above.

Big reset: What it means for the international monetary system and gold price

The international monetary system is "manmade," and it is possible to change it, Middelkoop told Kitco News.

“We could move away from a dollar-entered system towards a new phase for the international monetary system, where we could use a new common currency,” he said. “It might be a good idea to restructure the debt and revalue gold.”

Gold is very likely to play a key role in the new system because of how much gold is owned by central banks around the world. Click here to find out why central banks have been buying gold at a record pace last year.

“All countries east of Germany have been accumulating large amounts of physical gold. And this is a sign in itself because it clearly shows that countries expect something will happen within the monetary system,” Middelkoop said. “And even the Dutch central bank president has said that the Dutch still have a lot of gold because you need gold to restart the system when something goes wrong.”

But the big question is which country will make the first move. Middelkoop is not ruling out the U.S. surprising other countries by making the dollar gold-backed again.

“This goes for China, Russia, the EU, and the U.S. [If] you revalue gold to a much higher level, you can save the central banks’ balance sheets. And I still expected that to happen one day,” he said. “Who will move first? Who will start to back its currency with gold first? There are very few steps you can take as central bankers to rescue this monetary system.”

Middelkoop expects a very strong move in gold and silver in the next 5 to 10 years.

“You can also look at the ratio between gold and the amount of fiat money in circulation. We've seen gold readjust and revalue much higher … in the 1930s, in the 1970s, and between 2000 and 2011,” he said. “So once gold starts to run, and especially in a reevaluation scenario, it will go up 5x, 8x, 10x. So expect gold to move to $10,000.”

The revaluation of gold in this big monetary reset is just a matter of time, according to Middelkoop. For more immediate-term price action in the U.S. dollar and precious metals, watch the video above.

Story by Anna Golubova & Michelle Makori - Redacted bullet points by Jody Davis https://www.kitco.com/news/2023-08-28/How-gold-price-gets-to-10k-BRICS-expansion-gold-backed-currency-monetary-reset-Willem-Middelkoop.html