Your Parents Bought Groceries with Silver

A potential collapse of the U.S. dollar could create significant uncertainty, leading many to seek safer ways to protect their wealth and have hard money on hand in case there is a need for barter and trade. During periods of economic turmoil, civil unrest, or war, precious metals like silver emerge as a compelling option. Silver's value could increase dramatically if the dollar collapses.

For thousands of years, silver has been used as a tangible means of exchange, with societies around the world relying on it for trade and commerce. In the United States, silver was a key component of the nation’s currency until 1965, when the government fully abandoned the silver standard by removing it from coins. Just 60 years ago, many people, including your parents and grandparents, used silver to purchase everyday items like groceries.

This shift to fiat currency allowed governments more flexibility to print money but also introduced risks of inflation and devaluation, as currency was no longer backed by a tangible asset like silver. Despite this, silver remains a critical asset for wealth preservation, especially in times of economic uncertainty.

How Silver's Value Changes During a Dollar Collapse

The value of silver is closely tied to the strength of the U.S. dollar. When the dollar weakens, silver often rises in value. Throughout history, during times of currency crises or financial instability, silver has soared as a reliable hedge. Alongside gold, silver provides a practical and accessible way to preserve wealth—real money that exists beyond the reach of government control.

Unlike paper money or digital currencies like CBDCs, physical precious metals cannot be printed or erased with the stroke of a key. Silver offers the advantage of being private money you can hold, free from the oversight and tracking of the digital world.

Historical Lessons

Historically, silver prices have surged during periods of hyperinflation, such as in Germany in the 1920s and Zimbabwe in the 2000s. As national currencies plummeted, silver gained value, with prices in Germany rising by over 1,000% during its hyperinflation crisis. These examples highlight silver’s role as a stable asset in uncertain economic times.

Similarly, during the economic turmoil in the U.S. in the 1970s and early 1980s, silver prices soared in response to rising inflation. These historical patterns underscore silver’s ability to preserve value and provide stability, especially during financial crises or a potential dollar collapse.

Silver as a Currency

For centuries, countries around the world have used silver as the foundation of their monetary systems, often tying their currency's value directly to the metal in what was known as the silver standard. From ancient civilizations like Rome and China to 19th-century Europe and the United States, silver was a reliable store of value and a medium of exchange. Nations on the silver standard issued coins or paper money backed by physical silver, which provided stability and trust in their economies. This system allowed for international trade and economic growth, as silver’s intrinsic value was recognized globally.

The Role of Supply and Demand in Silver's Valuation

Silver’s value is influenced by industrial demand and investor sentiment. These two factors significantly shape the market’s perception of silver’s worth.

Industrial Demand

Silver is used in numerous industries, including electronics, solar panels, and medicine. High demand for silver products in these sectors can drive prices up. On the supply side, mining operations and production levels are essential to meeting industrial demand. Any disruption in mining can lead to a silver shortage, driving prices higher in global markets.

Investor Sentiment

Investor sentiment also plays a crucial role in determining silver’s market value. During times of economic uncertainty, more people seek out precious metals like silver, leading to higher demand and increasing prices. Understanding market dynamics is key to making informed investment decisions.

The Benefits of Precious Metals

For those looking to safeguard their savings accounts or retirement accounts, silver and gold offers several advantages:

- Inflation Protection: Precious metals like silver tend to retain their value over time, making them a reliable option for preserving savings.

- Economic Security: Silver acts as a safe haven during financial uncertainty, historically maintaining its value when currencies decline.

- Diversification: Silver often rises when other markets fall, providing a valuable hedge. Adding silver to your savings or IRA helps diversify your investments and spread risk across different asset classes.

- Tax Benefits: Silver IRAs offer tax benefits similar to other IRAs, including potential tax deductions and tax-deferred growth.

Open a Silver IRA or Choose Direct Delivery

Call 844-977-4653

We help you open your Silver IRA at ZERO-cost

Choose Confidently

Understand the advantages of Silver and what options are best for you

Receive Your Metals

Private direct delivery or to your depository of choice

How Does Silver Stack Up Against Other Safe-Haven Assets?

Silver is frequently compared to other safe-haven investments like gold. Although gold tends to be the preferred choice for many, silver presents distinct advantages, including its lower price point and higher industrial demand. These factors make silver more accessible to a wider range of investors seeking to safeguard their wealth.

Silver’s Performance During Economic Crises

Silver has historically shown strong performance during times of economic turmoil and high inflation. For example, during the 2008 financial crisis, silver prices rose dramatically as investors turned to precious metals for protection.

In the 1970s, another period marked by economic instability and inflation, silver prices experienced a significant surge. These instances illustrate how silver can serve as a reliable store of value when traditional currencies face devaluation. Its historical resilience makes silver an appealing option for those looking to protect their wealth during uncertain times.

For those seeking to diversify their savings, a Precious Metals IRA that includes both gold and silver offers a more comprehensive safety net. Additionally, silver coins and bars are widely available, easily liquidated, providing an accessible way to truly protect against paper investments and other illiquid investments.

Silver’s Unique Quality & Uses

Silver plays a vital role in modern technology and sustainable initiatives. Silver is indispensable in manufacturing due to its excellent conductivity and antibacterial qualities. It’s widely used in batteries, electronic devices, and water purification systems. As technological innovation continues, silver remains critical in the production of advanced electronics like smartphones and computers, owing to its superior electrical conductivity.

Silver’s antimicrobial properties also make it a key material in medical tools and coatings. As new discoveries emerge, silver’s application across multiple sectors continues to expand, driving demand in global markets.

Unless the world unplugs, the demand for silver will continue to rise.

Featured Silver Assets:

Silver American Eagle

U.S. Mint

Silver British Britannia

Royal Great Britain Mint

Silver Canadian Maple Leaf

Royal Canadian Mint

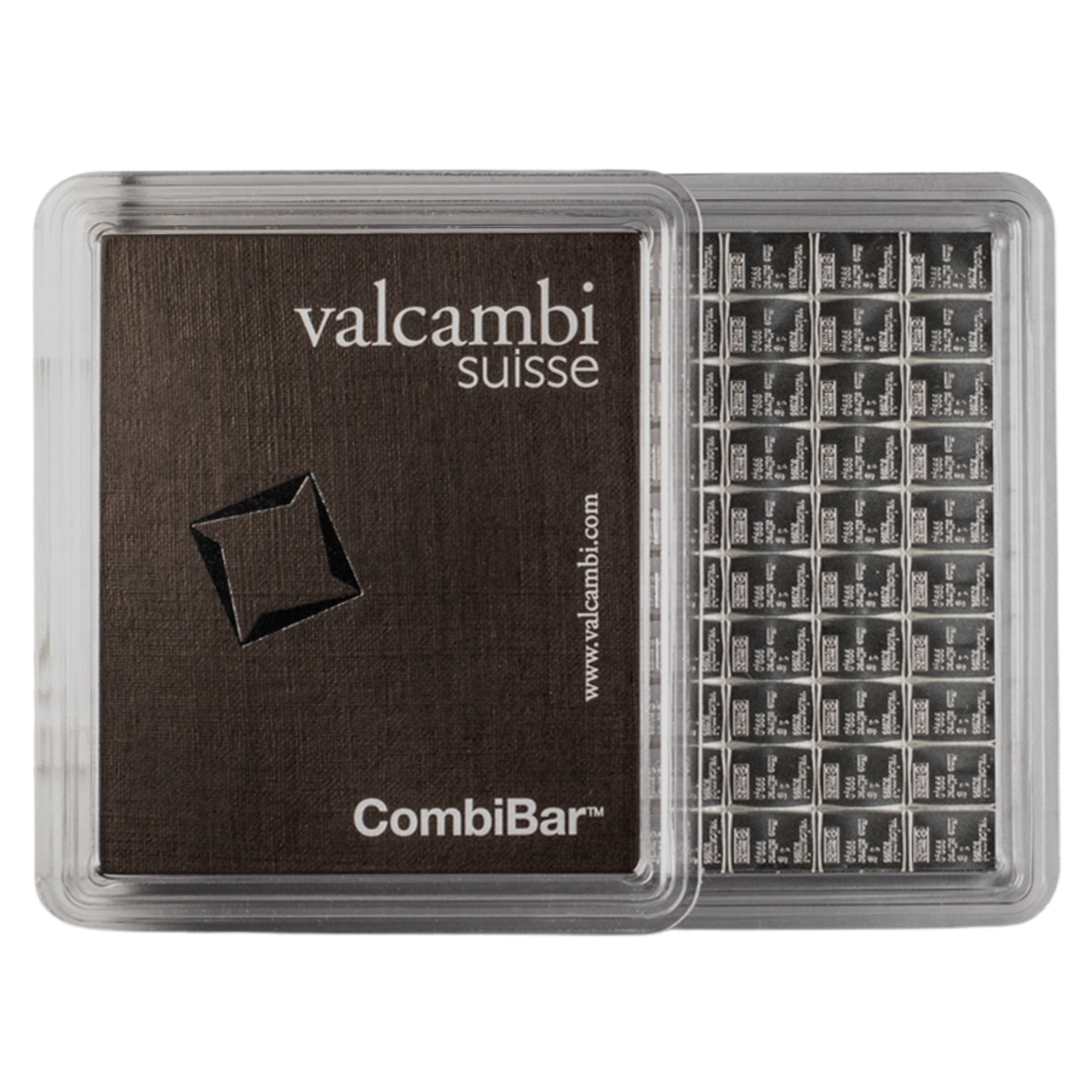

100g Valcambi Silver Bar

Suisse Mint