Two Common Questions:

Is Gold Better Than Silver? Is Silver Better Than Gold?

Without getting too technical or talking through hypotheticals, let's explore the most basic similarities and differences between gold and silver.

Both gold and silver are precious metals that have been used as money and for jewelry for thousands of years. They are both considered good investments that can hedge against economic downturns. Both metals tend to rise significantly during stagflation and long inflationary super-cycles, such as the 1970s and what we are experiencing now. Both metals are universally recognized as solid ways to preserve and diversify wealth, offering protection against financial uncertainty. They have historically proven their long-term value in confronting inflation, recessions, currency devaluation, market collapses, wars, and social upheaval.

Why Is Silver Cheaper Than Gold?

The primary reason gold is more valuable than silver is that there are far more silver deposits in the world than gold. The average ratio of silver to gold in the Earth's crust is estimated to be approximately 19:1.

The Choice Between Investing in Gold or Silver Ultimately Depends on Your Specific Goals and Objectives.

A Few Other Questions We Hear Often:

Again, we are keeping the answers simple when markets and people can be complex.

Why Physical Gold or Silver vs. ETFs or Mining Stocks?

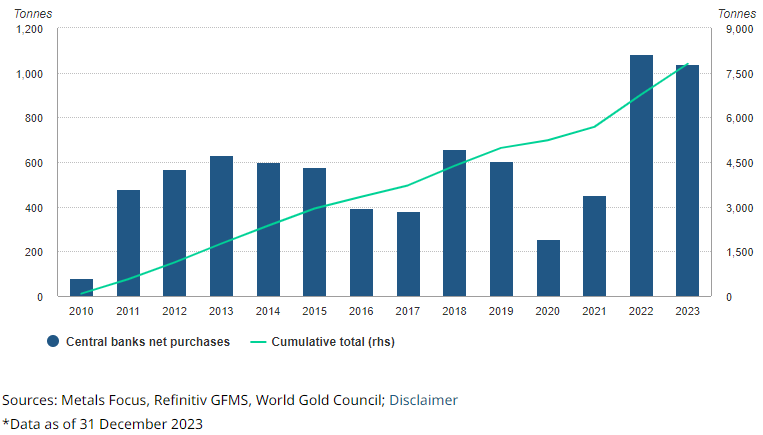

Neither countries nor central banks buy paper gold, gold ETFs, or mining stocks to hedge against financial calamities such as currency crises, declines, or collapses. If these were the best choices, governments would elect this option. Therefore, we believe that physical, tangible gold and silver are best for 'The People' too!

Beyond preserving purchasing power, physical gold and silver are portable, offer privacy in transactions, and serve as valuable means of passing wealth to future generations.

Physical gold and silver are among the most liquid investments. They are global money, with exchanges all over the world for the currency of your choice. Additionally, at Harvard Gold, we understand the importance of providing you with an easy, secure way to sell back some or all of the precious metals you have acquired. Rest assured, your HGG-purchased metals are never charged liquidation fees, and you can have dollars back in your hand as quickly as three days. We can assist with shipment and then issue your payment. Just call us to start the process at (844) 977-4653.

Why Doesn’t My Financial Advisor Recommend Buying Physical Gold and Silver?

Brokerage firms and financial advisors generate revenue in multiple ways; a primary source is commissions and fees, which are typically charged at both the beginning and end of transactions. Additionally, mutual funds are especially known for their high ongoing management fees, as opposed to fees charged solely when you buy or sell. Brokers or their companies also typically enjoy income or bonuses from ‘money under management’. These firms almost exclusively sell paper assets rather than physical assets. Therefore, they understand paper-gold and silver ETFs, mutual funds, and mining stocks. ETFs and many mining stocks are known for volatility, and they simply might be steering you away from that risk. Alternatively, they may be reluctant to suggest hedging with physical precious metals as it would lead to a decrease in money under management or loss of control of your money.

Why Diversify and Hedge Dollar-Denominated Assets

Diversifying your investments across various assets is a proven strategy critical for achieving long-term financial success. During The Great Recession of 2008, many investors 401K’s turned to 201K’s while home values plummeted 30-50% across America. This serves as a stark reminder of the perils of not hedging dollar-based assets and relying solely on the assurances of politicians and central bankers. In contrast, gold not only weathered the storm but thrived, exhibiting a 51% price increase from December 2008 to December 2009.

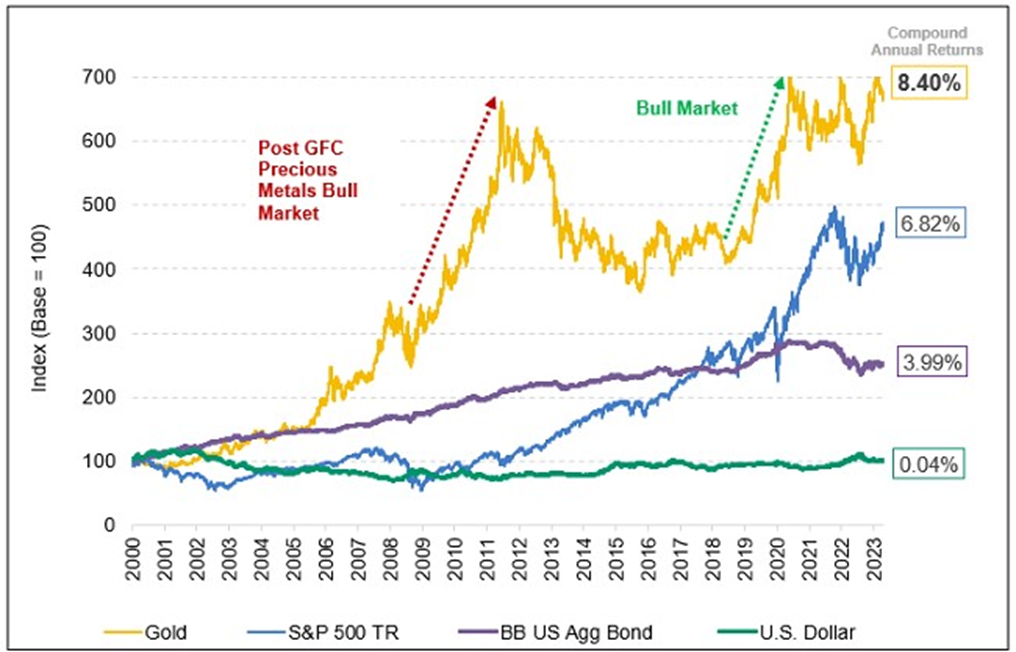

Since 2000, gold is up over 700% and has outperformed the broader equity and bond markets. Long-term investors who diversified with gold enjoyed steady portfolios with greater growth through the good economic times and cushioned the blows in the bad times in 2001, 2008, and 2020 market crashes.

Source: Bloomberg. Period from 12/31/1999 to 06/30/2023. Gold is measured by GOLDS Comdty Spot Price; S&P 500 TR is measured by the SPX; US Agg Bond Index is measured by the Bloomberg Barclays IS Agg Total Return Value Unhedged USD (LBUSTRUU Index); and the U.S. Dollar is measured by DXY Curncy. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Why Harvard Gold Group?

America's #1 Conservative Gold Company

As seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The Christian Post, The New York Sun, and more — Harvard Gold Group (HGG) is trusted nationwide for exceptional service and unmatched value.

We hold an A rating with the BBB and maintain a flawless 5-star reputation across the board, with zero complaints. Since 2010, our co-owners have helped Americans move over $100 million into tangible gold and silver, whether for retirement accounts or secure direct delivery.

Clients benefit from free consultations and metals overviews, tax-free purchases for eligible accounts, free 2-day insured shipping, a best-pricing policy, and lifetime account care. Every customer has direct access to our experienced co-owners, ensuring your precious metals investment is secure, straightforward, and backed by over a decade of expertise — along with a straightforward buyback program that has no hassle or liquidation fees.

✔ Tax-Free & Penalty-Free: A Rollover or Transfer of your Retirement Account is almost always tax-free and penalty-free.

✔ Free Metals/Promos: Earn up to $15,000 in FREE Gold/Silver/Promos, on qualifying purchases.

✔ Free Retirement Account Rollover/Transfer: Zero cost to rollover/transfer/move retirement accounts or IRAs to a Gold/Silver IRA. *You can also earn up to 10 years of FREE IRA yearly fees*.

✔ Privacy: We protect your privacy and believe it is a commodity as valuable as time— you can't get it back. We do not sell your information to third parties.

✔ HGG Lifetime Account Care: Providing a dedicated account specialist and keeping you updated with market news and trends.

✔ Harvard BuyBack Program: Hassle-free buyback of HGG metals with no liquidation fees.

✔ Guaranteed Precious Metals: We only deal in government-issued coins and qualified branded bars.

✔ Free Shipping: Enjoy free shipping and insurance on orders over $10k. You can opt to have them delivered directly to your home, business, or an independent depository.

✔ What is Our Lowest Price Guarantee? We are committed to offering you the best value possible, with a comprehensive price-match policy.

✔ Customer Satisfaction: Harvard Gold Group is a 5-star rated company committed to maintaining exceptional customer service satisfaction.

✔ You work directly with the founders of HGG.