There have been 17 significant currency resets in the U.S. over its 249-year history. Among these resets, some are considered soft (gradual policy adjustments and reforms), while others are classified as hard (drastic changes, devaluations, or structural overhauls).

For centuries, countries' currencies have flowed in cycles, intertwined with debt cycles. Typically, every 50–75 years, currency and debt cycles end simultaneously, undergoing a major hard reset, as seen after WWII (1944–1946). Over the next several weeks, we’ll share historical insights and perspectives to help provide a basic understanding of currency cycles, debt cycles, resets—and why physical gold remains critical in navigating these shifts. Harvard Gold Group, America’s #1 Christian Gold Company as seen on The Christian Post. Our information is FREE www.harvardgoldgroup.com.

Series 1 of 3:

U.S. Currency Cycles & Resets

We will focus the main part of this conversation on the most important currency resets of the past 80 years, as the goal is to educate people that the U.S. and the world are nearing a global hard reset. Understanding physical gold’s role in these major events is key to protecting generational wealth and your legacy.

** Don't miss at the bottom of the page... All 17 currency/monetary resets the U.S. has experienced over the 249 years of Independence. The most fascinating of all—2020, 2008, and 1934— might just BLOW YOUR MIND **

Historical Timeline of Currency Cycles & Resets

Bretton Woods Agreement in 1944-1946

This period marked a significant restructuring of both the global reserve currency and the financial system, as well as sovereign debt management, driven by the aftermath of World War II. The Currency & Debt Cycles were reset simultaneously.

Key Events Defining the 1944-1946 Debt & Currency Reset:

1. Bretton Woods Agreement (1944):

- The U.S. dollar dethroned the British pound sterling.

- Established the U.S. dollar as the world’s reserve currency, pegged to gold at $35 per ounce, while other currencies were pegged to the dollar.

- Created institutions like the International Monetary Fund (IMF) and the World Bank to stabilize global finance.

- This marked a currency reset because it redefined international monetary policy, established a new world's reserve currency, and shifted the world from the pre-war gold standard to a dollar-gold peg system.

2. Post-WWII Debt Management (1945–1946):

- The U.S. national debt had surged to over 100% of GDP due to wartime spending.

- To manage this, the U.S. adopted financial repression strategies: controlling interest rates, promoting inflation to erode debt, and encouraging domestic savings to finance the debt.

- Globally, war-torn nations restructured their debts through Marshall Plan aid and other financial mechanisms.

3. End of the Previous Gold Standard (1933–1946 Transition):

- The U.S. had abandoned the domestic gold standard in 1933 under FDR, but Bretton Woods reintroduced a modified gold linkage internationally.

- This was a monetary reset because it shifted the global economy from a pure gold standard to a more controlled, dollar-dominant system.

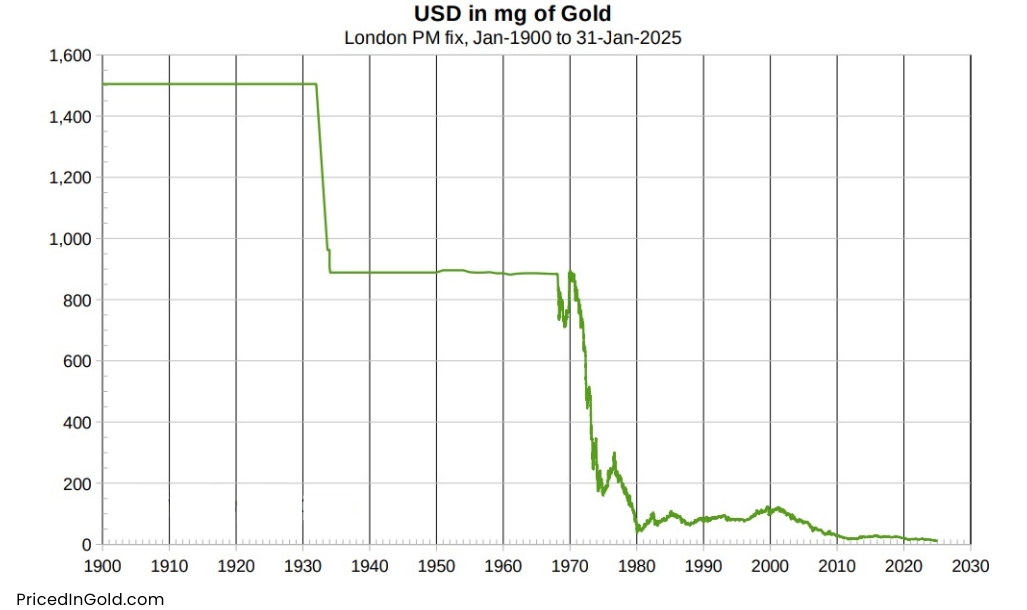

The Nixon Shock of 1971

In 1971, President Nixon shocked the world by ending the U.S. dollar's convertibility to gold, effectively breaking the Bretton Woods Agreement. This led to an immediate devaluation of the dollar as it quickly lost value against gold and other major currencies. Gold prices soared, rising from $35 per ounce (the fixed rate under Bretton Woods) to $106.48 by 1973.

In 1974, Nixon reached an agreement with Saudi Arabia to price oil exclusively in U.S. dollars, which was a soft reset. In return, the U.S. provided military protection and economic support to Saudi Arabia. This deal was later expanded to include other OPEC nations, solidifying the dollar’s dominance in global energy markets and reinforcing its status as the world’s primary reserve currency. It is important to note that gold surpassed $800 by 1980, reflecting the dollar’s decline in purchasing power and gold’s response to economic instability. To combat this, the U.S. raised interest rates in the late 1970s and early 1980s, but the damage to the dollar’s value had already been done.

Was The Nixon Shock of 1971 a Hard/Major Reset or a Soft Reset?

The Nixon Shock is often debated as to whether it qualifies as a "hard reset" or a "soft reset".

We consider the Nixon Shock a hard reset since it caused a dramatic loss of the dollar's purchasing power. However, it did not change the entire U.S. financial system and was followed in 1974 by a soft reset—the petrodollar—which, thankfully, secured the dollar as the world's dominant reserve currency.

Regarding the 1971 Nixon Shock, here are the debated points of view. You can decide for yourself whether it was a hard or soft reset.

Why It Could Be Considered a Hard/Major Reset:

1. End of the Bretton Woods System:

- The 1971 suspension of the gold standard effectively dismantled the Bretton Woods system, which had governed global finance since 1944.

- Devalued the dollar in the short and long term.

- This marked the shift to a fiat (paper) currency system, where the U.S. dollar (and other currencies) were no longer backed by gold, but by the “full faith and credit” of governments.

2. Global Impact:

- The dollar was the anchor currency for the world. Once its gold link was severed, other nations were forced to adapt.

- It led to the creation of the floating exchange rate system we have today, fundamentally altering global trade, finance, and monetary policy

Why It Might Be Considered a Soft Reset:

1. Continuity of the Dollar’s Role:

- Despite the gold decoupling, the U.S. dollar remained the global reserve currency, maintaining its dominant position in international trade and finance.

- There was no immediate collapse or overhaul of the financial system—just an adaptation to new rules.

2. No Global Debt Jubilee or Widespread Defaults:

- Unlike true historical "hard resets" (e.g., post-WWII restructurings), the Nixon Shock didn’t involve mass debt cancellations or currency redenominations.

- Instead, it was a monetary policy pivot that governments and markets gradually adjusted to over time.

3. Absence of a New Global Monetary System:

- Bretton Woods created new institutions (IMF, World Bank) and a clear global framework.

- The Nixon Shock dismantled the old system but didn’t replace it with an equally structured new one. The world shifted to a decentralized, fiat-based system without formal global consensus.

Perspectives:

- If you define a "currency reset" as a complete overhaul of the global financial system with new rules, institutions, and debt restructuring, then the Nixon Shock was more of a "soft reset."

- If you define it as a fundamental shift in how money works globally, then it qualifies as a major reset because it ended the dollar-gold-backed era and ushered in the fiat currency age.

Conclusion:

Either way, the Nixon event did not deal with the end of a global debt cycle, so the last global debt and currency simultaneous ‘hard/major reset’ was 1944-1946— 80 years has passed, and the writing on the wall says we are nearing the next global reset.

Why Currency/Monetary Resets Happen (Soft & Hard Resets)

Currency and monetary resets—whether soft or hard—occur because financial systems become unstable or unsustainable over time. This happens due to a mix of debt buildup, policy failures, economic imbalances, and shifts in global power.

-

The Core Reason: The System Becomes Unsustainable

- Over time, governments accumulate too much debt and create too much money

- The currency loses value, the economy slows, and the system can’t function properly without major changes

-

Why Soft Resets Happen (Gradual Adjustments):

-

- Purpose: To fix problems before they become a crisis

- Common Triggers:

- Economic slowdowns or recessions

- Policy shifts (like changing interest rates or creating central banks)

- Need for financial reforms without causing panic

- How It Works: Governments tweak monetary policies, adjust currency values, or introduce new financial rules gradually

-

Why Hard Resets Happen (Drastic Changes):

-

- Purpose: To respond to a full-blown crisis when soft fixes are no longer enough

- Common Triggers:

- Debt crises (debt is too large to repay)

- Currency collapse or hyperinflation

- War or global conflict

- Loss of trust in the financial system – bank runs

- How It Works:

- Currency devaluation or replacement

- Debt defaults or restructuring

- Confiscation of assets (like gold in 1933)

- New monetary systems (like Bretton Woods in 1944)

-

The Cycle of Resets:

-

- Governments spend → accumulate debt → print money → devalue currency → crisis → reset.

- This cycle repeats because human nature (greed, short-term thinking) drives policies that eventually break the system

Where We Are Now

Where are we now according to The US Bureau of Labor Statistics CPI Inflation Calculator

From Jan 1971 to Dec 2024 (their last update for CPI statistics): The U.S. dollar has lost approximately 87.16% of its purchasing power. This means that what $1 could buy in 1971 now requires about $7.79.

For thousands of years, countries go on and off gold standards. Get informed and get prepared: put your family on a gold standard today with Harvard Gold Group: (844) 977-4653

All our information is free www.harvardgoldgroup.com

** Don't miss at the bottom of the page... All 17 currency/monetary resets the U.S. has experienced over the 249 years of Independence. The most fascinating of all—2020, 2008, and 1934— might just BLOW YOUR MIND **

The Lord is at the center of our business and interactions with all customers. That's why we are committed to providing you with the best possible experience and value when purchasing metals for direct delivery, storage, or setting up a Precious Metals Retirement Account/IRA.

With 5-star ratings across the board, BBB-A+, as seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The New York Sun; HGG stands out as America’s #1 Christian & Conservative Gold Company.

Our team prioritizes exceptional support and customer service for all your precious metal needs. Customers also benefit from our quick, easy, and hassle-free Buy-Back program with no liquidation fees. Your privacy is our priority—because, like time, once it’s gone, you can’t get it back. Harvard Gold Group, HGG is fully dedicated to building relationships founded on trust, one transaction at a time.

All 17 Currency & Monetary Policy Resets for the U.S. 2025-1776 (249 years)

Here’s a chronological list of significant currency resets in U.S. history, categorized as soft (gradual policy shifts, reforms) or hard/major (drastic changes, devaluations, or structural overhauls):

These resets reflect the evolving nature of U.S. monetary policy, shifting between periods of hard money-gold, fiat experiments, and central banking reforms.

1. COVID-19 Monetary Response (2020) – Soft Reset

- What Happened: Massive stimulus packages, rapid expansion of the Federal Reserve’s balance sheet, and near-zero interest rates to stabilize the economy.

- Impact: Accelerated the shift toward modern monetary theory (MMT)- style policies, normalizing large-scale money creation and government intervention.

- The unprecedented waves of new money injected into existence fueled an explosive rise in inflation (devaluation of the dollar).

- Gold Jan 1, 2020, $1,518.40 – today February 10, 2025 gold is range trading between $2,910 and $1,938 = Gold Percentage Gain at $1,910 is effectively 91.65%.

- Why It’s a Soft Reset: Central Banks changed monetary policy expectations without a formal structural overhaul.

2. Global Financial Crisis Response (2008) – Soft Reset

- What Happened: Introduction of Quantitative Easing (QE), which simply means ‘printing money electronically’ to inject newly created cash into the financial system. They also performed selective government debt bailouts, forgiving the debts of certain banks, financial institutions, insurance companies, and corporations, and transferring much of that debt onto taxpayers. Additionally, they introduced unprecedented Federal Reserve intervention in financial markets.

- Impact: Key Impacts of the 2008 QE Response:

-

- Redefined the Role of Central Banks:

- The Federal Reserve became more active in managing economic stability, using QE as a primary tool.

- Normalized Massive Debt Monetization:

- The Fed’s large-scale purchase of government debt blurred the lines between monetary policy and direct debt financing.

- Laid the Groundwork for Future Monetary Expansions (Printing Money):

- QE became a standard tool, leading to even larger programs in later crises (e.g., COVID-19 in 2020).

- Contributed to the Devaluation of the Dollar:

- While not an immediate, sharp devaluation, the massive increase in the money supply reduced the dollar’s purchasing power over time.

- This was reflected in asset price inflation (stocks, real estate) and, eventually, consumer price inflation in the following decade.

- Redefined the Role of Central Banks:

- Why It’s a Soft Reset: The U.S. made big central bank policy shifts with long-term negative inflationary effects, but there was no sudden massive devaluation of the dollar.

3. 1971 Nixon Unpegged the Dollar from Gold (Nixon Shock) – Dismantling the Bretton Woods Agreement

- What Happened: Abandonment of the Gold Standard (1971) – known as the Nixon Shock, the U.S. unilaterally ended the dollar’s convertibility to gold, severing the last tie to the gold standard. Some people argue this is a soft reset, while others argue it was a hard reset since it removed the world from a gold standard.

- Impact: Key Impacts of the Nixon Shock 1971

-

- Transitioned the world to a pure fiat currency system:

-

Leading to floating exchange rates and significant currency volatility, the policy shift had a lasting impact on global markets.

-

- Opened the door for all countries to manipulate/devalue their currencies:

- For governments, devaluating their currency makes it easier for them to manage debt. Effectively creating inflation which reduces the real value of the debt. It also boosts Exports because a weaker currency makes exports cheaper for other countries, helping domestic industries sell more abroad. This act of devaluing currency may be beneficial for the government, but not for the people. It reduces the purchasing power of their dollar, buying less and less over time because prices rise (inflation), eroding savings and wages. Inflation acts like a tax, quietly taking wealth from the public without raising actual taxes.

- Transitioned the world to a pure fiat currency system:

- There is a debate over whether this was a Soft Reset or a Hard Reset: You can read both sides of the debate at the top of the article.

4. Establishment of the Petrodollar System (1974) – Soft Reset

- What Happened: The U.S. negotiated with Saudi Arabia to price oil exclusively in U.S. dollars, securing global demand for the dollar despite its fiat status.

- Impact: Cemented the dollar’s role as the world’s reserve currency, stabilizing its dominance post-gold standard.

- Why It’s a Soft Reset: Major geopolitical and economic shift, but without formal currency restructuring.

5. Treasury-Fed Accord (1951) – Soft Reset

- What Happened: It ended the Federal Reserve’s obligation to keep interest rates low to finance government debt, restoring its independence in monetary policy.

- Impact: Allowed the Fed to combat inflation more effectively, shaping modern central banking.

- Why It’s a Soft Reset: Adjusted monetary control without directly altering the currency value itself.

6. Bretton Woods Agreement (1944) – Hard Reset

- What Happened: It established the U.S. dollar as the global reserve currency, pegged to gold at $35/oz, with other currencies tied to the dollar.

- Impact: Restructured the global monetary system after WWII, shifting from gold-based systems to a Paper Dollar-Centric World Order.

- Why It’s a Hard Reset: Complete overhaul of the global international financial system and cemented U.S. dollar dominance.

7. Gold Reserve Act (1934) – Hard Reset

- What Happened: Nationalized gold held by the Federal Reserve, revalued gold from $20.67 to $35/oz, effectively devaluing the dollar.

- Impact: Cemented the U.S. government's control over monetary policy and gold, weakening the dollar’s direct gold link for citizens.

- Why It’s a Hard Reset: It forcibly revalued the dollar, centralized gold ownership under the government, and marked a drastic shift in monetary control.

Important Details:

The 1934 Hard Reset in the U.S., marked by the Gold Reserve Act, had a major impact on the American people and their purchasing power. Here’s how:

What Happened:

- The government had just performed a hard reset in 1933 by confiscating private gold (via Executive Order 6102), forcing citizens to turn in their gold at a fixed price of $20.67 per ounce.

- In 1934, after collecting the gold, the government revalued gold to $35 per ounce, effectively devaluing the U.S. dollar by 41% overnight.

Impact on the People:

- Loss of Wealth:

- Citizens lost out on the 41% gain because they had already turned in their gold at a lower price.

- This was a direct wealth transfer from the public to the government.

- Reduced Purchasing Power:

- The dollar’s value dropped significantly, meaning people’s savings bought less over time.

- Prices of goods and services gradually increased as the weaker dollar affected the economy.

- Erosion of Trust:

- Many felt betrayed because the government had promised to protect the value of the dollar, only to devalue it immediately after confiscating gold.

- Debt Relief for the Government:

- The devaluation reduced the real burden of government debt, as the U.S. could pay back debts with cheaper dollars.

The Bottom Line:

- The government benefited by reducing debt and boosting gold reserves.

- The people suffered through lost wealth, reduced purchasing power, and higher living costs in the following years.

- It was, effectively, a hidden tax on savings and wealth disguised as monetary policy.

8. Gold Confiscation & Dollar Devaluation (1933) – Hard Reset

- What Happened: Under Executive Order 6102, Americans were forced to surrender gold to the government; private gold ownership was banned.

- Impact: It ended the domestic gold standard, massively devalued the dollar overnight, and expanded government control over the dollar.

- Why It’s a Hard Reset: It forcibly revalued the dollar, centralized gold ownership under the government, and marked a drastic shift in monetary control; devaluing the currency overnight.

9. Federal Reserve Act (1913) – Soft Reset

- What Happened: Created the Federal Reserve System, introducing centralized control over monetary policy and issuing Federal Reserve Notes.

- Impact: Shifted the U.S. from decentralized banking to a central bank model, laying the groundwork for modern monetary policy.

- Why It’s a Soft Reset: It restructured the financial system without causing immediate currency devaluation or loss of public trust in the dollar.

10. Coinage Act of 1900 (Gold Standard Act) – Soft Reset

- What Happened: Officially established the gold standard in the U.S., ending the bimetallism debate (gold and silver backing).

- Impact: Stabilized the dollar’s value exclusively to gold, reducing silver’s role in monetary policy.

- Why It’s a Soft Reset: It clarified monetary policy without drastic economic upheaval or altering the fundamental value of the currency.

11. Coinage Act of 1873 (The “Crime of ’73”) – Hard Reset

- What Happened: Demonetized silver, effectively ending bimetallism without public debate, moving the U.S. toward a de facto gold standard.

- Impact: Triggered deflation and economic hardship for debtors, sparking the Free Silver Movement in response.

- Why It’s a Hard Reset: It abruptly removed silver from the monetary system, significantly impacting the economy and leading to social unrest.

12. National Banking Acts (1863–1864) – Soft Reset

- What Happened: Created a system of national banks and introduced a uniform national currency, backed by U.S. government bonds.

- Impact: Standardized U.S. currency, reducing reliance on state-issued banknotes, strengthening federal monetary authority.

- Why It’s a Soft Reset: It reformed the banking system without devaluing currency or causing financial crises during implementation.

13. Legal Tender Act (1862) – Hard Reset

- What Happened: Authorized the issuance of “greenbacks”—fiat paper currency not backed by gold or silver—to finance the Civil War.

- Impact: Marked the first major departure from hard money, introducing fiat currency into the U.S. economy.

- Why It’s a Hard Reset: It represented a sudden shift from metal-backed money to fiat currency, creating inflation and legal battles over its legitimacy.

14. Coinage Act of 1834 – Soft Reset

- What Happened: Adjusted the gold-to-silver ratio, effectively devaluing silver and making gold the dominant currency metal.

- Impact: Encouraged gold circulation and shifted U.S. monetary policy toward a gold standard foundation.

- Why It’s a Soft Reset: It modified the metal ratio without completely overhauling the currency system or causing immediate economic shock.

15. Second Bank of the United States Closure (1836) – Hard Reset

- What Happened: President Andrew Jackson vetoed the recharter of the Second Bank, ending central banking for decades.

- Impact: Led to a period of “free banking,” causing monetary instability, bank failures, and economic panics.

- Why It’s a Hard Reset: The abrupt removal of central banking oversight led to widespread financial instability and economic crises.

16. Coinage Act of 1792 (Establishment of the U.S. Dollar) – Soft Reset

- What Happened: Created the U.S. Mint and established the dollar as the official currency, based on bimetallism (gold & silver).

- Impact: Provided a standardized currency system, replacing the mix of foreign coins used after independence.

- Why It’s a Soft Reset: It established a formal currency system without disrupting existing economic stability.

17. Continental Currency Collapse (1775–1781) – Hard Reset

- What Happened: The Continental Congress issued paper money (“Continentals”) to fund the Revolutionary War, leading to hyperinflation and collapse.

- Impact: Destroyed public trust in paper currency, reinforcing the importance of hard money (gold and silver) in the post-war period.

- Why It’s a Hard Reset: The collapse resulted in the complete loss of currency value, requiring a total reset of the monetary system post-independence.

These 17 resets reflect the evolving nature of U.S. monetary policy, shifting between periods of hard money-gold, fiat experiments, and central banking reforms.

For thousands of years, countries go on and off gold standards. The U.S. has only been around for 249 years. Get informed and get prepared, put your family on a gold standard today with Harvard Gold Group, America’s #1 Christian Gold Company (844) 977-4653