For centuries, countries' currencies have flowed in cycles, intertwined with debt cycles. Typically, every 50–75 years, currency and debt cycles end simultaneously, undergoing a major hard reset, as seen after WWII (1944–1946). Over the next several weeks, we’ll share historical insights and perspectives to help provide a basic understanding of currency cycles, debt cycles, resets—and why physical gold remains critical in navigating these shifts. Harvard Gold Group, America’s #1 Conservative Gold Company: Our information is FREE www.harvardgoldgroup.com.

Series 2 of 3:

U.S. Debt Cycles, Boom to Bust

As of January 2025, the U.S. Debt Stands at $36.2 Trillion

It seems most people in America are numb to hearing about the massive debt the U.S. has gotten itself into.

Many people said that the 2008 financial crisis shocked them and took them by surprise. They took huge losses and, out of fear, spent years sitting on the financial sidelines. Meanwhile, financial institutions and individuals who understood cycles binge-purchased extremely undervalued assets.

It is Harvard Gold Group’s objective to use our exclusive partnership with Not the Bee to help educate people so that they can choose to prepare instead of being surprised or scared.

We will be providing a high-level overview with simple historical breakdowns so you can see the smaller and larger cycles and how they affected the people. Within it all, you will see how gold is not just the answer for central banks preparing their countries, it is an amazing hedge for people. Gold can help. You do not have to lose for others to gain, nor do you need to be afraid if a black swan event crashes the bigger cycle sooner rather than later.

** Don't Miss Series 1 of 3: U.S. Currency Cycles & Resets

(Hard Reset Imminent — History They Don't Teach: 17 U.S. Currency Resets)**

Let's Get into It >> Debt Cycles

Debt cycles and currency cycles/resets are related but distinct economic phenomena, though they often influence each other and once in a great while, converge simultaneously into a great reset.

Debt Cycles:

Debt cycles revolve around the accumulation and repayment of debt over time. They can be broken down into:

Short-Term Debt Cycles (5–10 years): Debt cycles are a recurring pattern in U.S. history, reflecting how economies expand through borrowing, reach unsustainable debt levels, and eventually reset through financial crises, restructuring, or currency devaluation. These cycles are driven by credit expansion and contraction, often leading to booms and busts (e.g., the 2008 financial crisis).

- Short-Term Debt Cycle Pattern: Revolve around the natural economic flow of growth, borrowing, and correction.

Key characteristics include:- Easy credit conditions → leads to excessive borrowing.

- Overheating economy → inflation rises.

- Central bank intervention → raise interest rates to cool down the economy.

- Recession → debt becomes unsustainable, triggering defaults or corrections.

Long-Term Debt Cycles (typically 50–75 years): Occur when debt levels become unsustainable, leading to deleveraging, defaults, or restructuring of debt (e.g., the Great Depression or post-WWII debt resets).

- The Long-Term Debt Cycle Pattern:

Key characteristics include:- Expansion Phase → Governments and individuals borrow heavily during periods of growth and low interest rates.

- Crisis Phase → Debt becomes unsustainable, leading to defaults, currency devaluations, or economic collapse.

- Reset Phase → Debt is either restructured, inflated away, or written off, often accompanied by political and social upheaval.

- Recovery Phase → The economy stabilizes slowly after a debt reset, often through a painful process. People endure devalued currency, job losses, lower wages, higher taxes, and a declining standard of living. Many lose their retirement savings and must rebuild amid economic and social turmoil. This phase can last years or even decades before confidence returns.

Currency Cycles:

We talked extensively about this last week. At the bottom of this series, you can click a link to go back to read last week’s topic: 17 US Currency Resets in 249 years.

Quick Recap: Currency Cycles Refer to Fluctuations in a Currency’s Value Due to Factors Like:

- Monetary Policy: Interest rates, money supply, and inflation.

- Trade Balances: Import/export dynamics affect demand for a currency.

- Global Confidence: Geopolitical stability and economic strength impact currency trust.

How They Interact with Debt Cycles:

While Separate, These Cycles Are Often Intertwined:

- High Debt Levels → Currency Devaluation: Governments may print money to service debt, leading to inflation or currency depreciation.

- Currency Crises → Debt Crises: A collapsing currency can make foreign-denominated debt unmanageable, triggering defaults (as seen in Argentina’s crises).

- Interest Rates Link Both: Central banks use rates to manage both debt burdens and currency strength.

Key Insight:

While debt cycles focus on credit dynamics and economic growth patterns, currency cycles revolve around monetary value and purchasing power. However, when debt reaches critical levels, it often leads to currency devaluation as a form of "soft default," showing their interconnected nature.

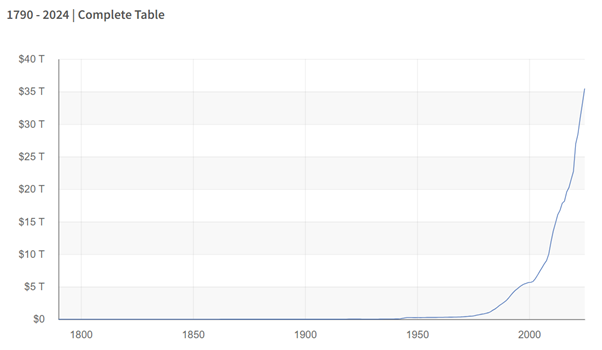

How Fast the Debt Doubles Reflects the Closeness of the End of a Major Debt Cycle

Historically, the U.S. national debt has doubled over varying periods, but recent decades have seen a significant acceleration in this trend.

Analyzing historical data from the U.S. Treasury reveals significant patterns in the national debt's growth since World War II. By examining the periods it took for the debt to double, we can gain insights into the current trajectory of the larger debt cycle.

Source Historical Debt Outstanding | U.S. Treasury Fiscal Data: Historical Debt Outstanding is a dataset that provides a summary of the U.S. government's total outstanding debt at the end of each fiscal year from 1789 to the current year. Between 1789 and 1842, the fiscal year began in January. From January 1842 until 1977, the fiscal year began in July. From July 1977 onwards, the fiscal year started in October. Between 1789 and 1919, debt outstanding was presented as of the first day of the next fiscal year. From 1920 onwards, debt outstanding has been presented as of the final day of the fiscal year. This is a high-level summary of historical public debt.

This rapid accumulation of debt is fiscally unsustainable. This rapid increase underscores the accelerating pace at which the debt is doubling, suggesting that the current larger debt cycle is approaching a critical juncture as we near its end.

U.S. Debt Milestones

The U.S. debt hit 1 trillion on Oct 23, 1981

It took the U.S. 205 years (1776 to 1981) to hit 1 trillion in debt.

The U.S. debt hit 10 trillion on Oct 3, 2008

In just 27 years we added an additional 9 trillion in debt.

The U.S. debt hit 20 trillion on Sept 17, 2017

In just 9 years we added an additional 10 trillion in debt.

The U.S. debt hit 30 trillion on Feb 1, 2022

In just 5 years we added an additional 10 trillion in debt.

Feb 1, 2025, the U.S. debt is $36.2 trillion

In just 3 years we have added about 6.2 trillion to our debt burden.

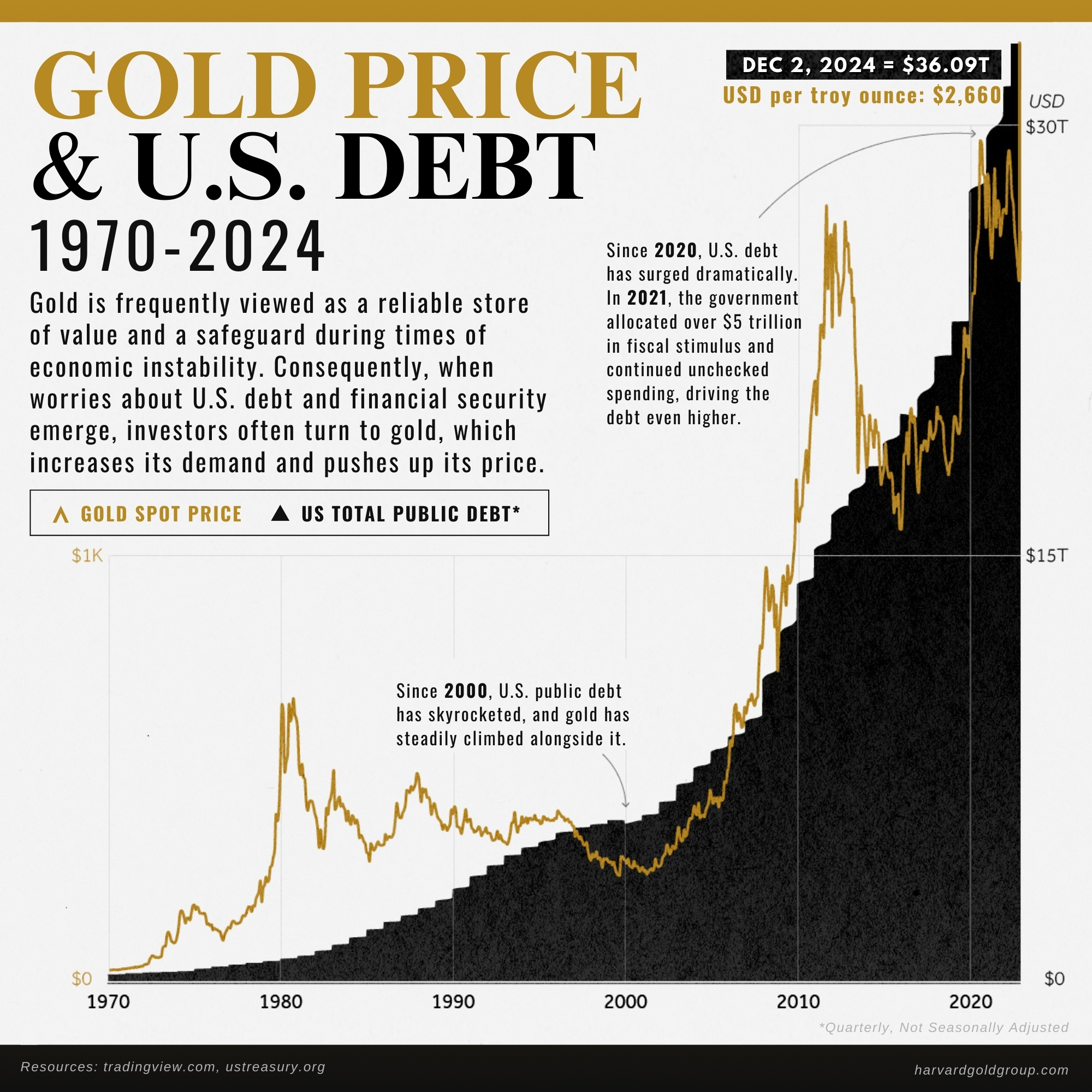

U.S. Debt to Gold

Oct 23, 1981 —

Oct 3, 2008 —

Sept 17, 2017 —

Feb 1, 2022 —

Feb 7, 2025 —

$436.70

$872.15

$1,279.45

$1,796.72

$ 2857.36

Are We Nearing the End of Another Long-Term Debt Cycle?

Economies operate in short-term and long-term debt cycles. The short-term debt cycle (typically 5-10 years) is marked by expansions and recessions, while the long-term debt cycle (usually 50-75 years) is when debt accumulation reaches unsustainable levels, leading to a system reset.

Indicators of a Debt Cycle Collapse:

- Unprecedented Global Debt Levels

- Global debt has surpassed $315 trillion, with U.S. national debt exceeding $36 trillion, growing at a pace that cannot be repaid under normal economic conditions.

- Historically, when debt-to-GDP ratios exceed 100%, economies struggle to generate enough productivity to sustain the debt burden.

- The Cost of Servicing Debt is Unmanageable

- Interest payments on U.S. debt now exceed $1 trillion annually, making debt repayment increasingly difficult.

- The Federal Reserve has been forced to keep interest rates higher to fight inflation, but this raises borrowing costs, pushing both governments and businesses toward insolvency.

- The “Debt Trap” Effect

- Governments are borrowing more just to pay interest on existing debt, a classic sign of a debt cycle end.

- Eventually, investors lose confidence in bonds and government debt, leading to either monetary debasement or a default event.

- Rising Inflation and Currency Devaluation

- When governments can no longer afford to service their debt, they print more money, devaluing their own currency.

- This causes a surge in inflation, lowering the purchasing power of fiat currencies.

Are We at the End of a Fiat Currency Cycle?

Fiat currencies historically have an average lifespan of about 50 years before being replaced, restructured, or collapsing. The U.S. dollar went off the gold standard in 1971, making it a pure fiat currency for over 50 years. Now, we are at the stage where fiat money is facing major systemic risks.

Signs of a Fiat Currency Endgame:

- Loss of Confidence in the U.S. Dollar

- Central banks worldwide are dumping U.S. Treasuries and buying record amounts of physical gold as they anticipate a shift away from the dollar.

- The BRICS bloc (Brazil, Russia, India, China, South Africa) is working on an alternative currency system backed by gold and commodities, challenging the dollar's global reserve status.

- Hyperinflation and Currency Debasement

- The U.S. has printed trillions of dollars in the last few years, drastically weakening the purchasing power of the dollar.

- Other fiat currencies, such as the Euro, Yen, and Yuan, are also facing similar devaluation pressures.

- Rising Popularity of Hard Assets - Gold

- When fiat systems are close to collapsing or collapse, people turn to tangible stores of value like gold. Gold is near all-time highs even with the dollar having strength over other countries paper fiat currencies and bonds/treasuries offering attractive yields not seen in many years… instead of gold retreating, you are seeing countries and smart money buying physical gold.

- You are seeing people buying into alternative made-up assets like cryptocurrencies, which directly show lack of trust in the governments.

- Gold prices are reaching record highs, reflecting the growing distrust in fiat money.

- Monetary System Reset Talks & Talks of Brentwood’s II

- Global elites, including the IMF and World Economic Forum (WEF), are openly discussing the need for a monetary reset, which could involve:

- A transition to Central Bank Digital Currencies (CBDCs).

- A return to some form of commodity-backed currency.

- A restructuring of global debt through debt forgiveness or massive inflation.

- Global elites, including the IMF and World Economic Forum (WEF), are openly discussing the need for a monetary reset, which could involve:

What Comes Next…

There is a Period of Financial Repression – Governments will attempt to control the transition by implementing stricter capital controls and higher taxation.

Historically, the Last Step is a Shift Back to Gold-Backed Currencies.

This is Historical When Countries Shift Back to Gold-Backed Currencies – More countries are turning to gold and other commodities to back new financial systems. It is not far-fetched to consider the possibility of the U.S. repurposing the dollar. This could mean a currency reset, where the U.S. dollar and its allied currencies are revalued—potentially backed partially by gold, the dollar, or a combination of allied currencies.

The world is near the end of both a currency cycle and a debt cycle. Historically, resets have come after devastation. Why not proactively restructure the system before a crisis, potentially avoiding world war, a massive recession, or even a depression?

Conclusion:

No one knows exactly when or how this Great Reset will occur, if it ends with an orderly restructure, or if we repeat the worst parts of history and it ends in war and destruction that results in a new world order… either way… all roads lead to physical gold.

5 Major Long-Term Debt Cycles in U.S. History:

1. The Revolutionary War Debt Crisis (1775–1790) – Hard Reset

- Debt Accumulation: The Continental Congress financed the war through massive borrowing and printing of “Continentals”, which collapsed due to hyperinflation.

- Reset: The new U.S. Constitution centralized fiscal power, created the U.S. dollar, and restructured war debts under Alexander Hamilton’s financial plan, restoring creditworthiness.

2. The Civil War Debt Cycle (1861–1879) – Hard Reset

- Debt Accumulation: The Union issued “greenbacks” (fiat currency) and incurred massive debt to finance the war. This caused inflation and a dual currency system—gold-backed money and paper money.

- Reset: The Resumption Act of 1875 restored the gold standard in 1879, effectively ending the use of greenbacks and stabilizing the currency after years of inflation and debt expansion.

3. The Great Depression & New Deal (1929–1944) – Hard Reset

- Debt Accumulation: The 1920s credit boom led to the 1929 crash, deflation, and widespread debt defaults.

- Reset: In 1933, President FDR abandoned the gold standard domestically, confiscated gold, and devalued the dollar (raising gold from $20.67 to $35/oz).

- Bretton Woods Agreement (1944): Established the U.S. dollar as the global reserve currency, pegged to gold, while other currencies were pegged to the dollar—a new global monetary system.

4. The Post-WWII Debt Cycle (1944–1971) – Soft Reset Leading to Hard Reset

- Debt Accumulation: WWII led to massive government debt. The U.S. maintained control through financial repression—low-interest rates and inflation to reduce debt.

- Reset: The Nixon Shock (1971) ended the dollar’s convertibility to gold, transitioning to a fiat currency system—a major monetary reset that paved the way for today’s financial system.

5. The 2008 Financial Crisis & 2020 Pandemic Response – Soft Resets with Long-Term Consequences – Currently Leading Towards a Hard Reset

- Debt Accumulation: Decades of easy credit led to the 2008 housing crisis, followed by Quantitative Easing (QE), which flooded the economy with money.

- 2020 Pandemic Response: Government spending skyrocketed, and the Fed printed trillions, causing record-high debt levels and triggering the highest inflation in 40 years.

- Potential Reset Ahead: Many economists believe we’re nearing another hard reset due to unsustainable debt, persistent inflation, and global monetary shifts.

The Lord is at the center of our business and interactions with all customers. That's why we are committed to providing you with the best possible experience and value when purchasing metals for direct delivery, storage, or setting up a Precious Metals Retirement Account/IRA.

With 5-star ratings across the board, BBB-A+, as seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The New York Sun; HGG stands out as America’s #1 Christian & Conservative Gold Company.

Our team prioritizes exceptional support and customer service for all your precious metal needs. Customers also benefit from our quick, easy, and hassle-free Buy-Back program with no liquidation fees. Your privacy is our priority—because, like time, once it’s gone, you can’t get it back. Harvard Gold Group, HGG is fully dedicated to building relationships founded on trust, one transaction at a time.