Silver is a dual investment vehicle, providing protection as a safe-haven asset while its special properties enable industrial applications in thousands of products, providing benefits not found in other assets.

Silver is a Safe-Haven Asset

Silver, like gold, is considered a safe-haven asset because its value tends to increase significantly during times of inflation, economic instability, or geopolitical uncertainty. Silver and gold are also considered safe-haven assets because they have intrinsic value that is not subject to inflation by central banks or fiat currencies and are the oldest form of true money. The most important hedge people should consider is to protect against currency collapse or a major shift in the U.S. dollar as the number one reserve currency in the world. These negative transitions have already begun.

Looking at Silver’s History as Money

Silver's journey as a form of money began around 600 BCE with the ancient Lydians, who inhabited what is now western Turkey. This innovative civilization was among the first to mint coins, using electrum, a naturally occurring alloy of gold and silver. These early coins were stamped with various images to indicate value and ensure authenticity, which greatly facilitated trade and commerce by providing a standardized medium of exchange.

The Lydian coinage system marked a revolutionary shift from barter to monetary economies, as it allowed for more efficient and reliable transactions. The success of Lydian coins set a precedent that quickly spread to neighboring regions. In ancient Greece, for example, silver coins became widespread, particularly with the introduction of the Athenian tetradrachm. These silver coins were known for their consistent weight and purity, making them widely accepted and trusted across the Mediterranean.

The influence of silver coinage extended further with the Roman Empire, which adopted silver denarii as the foundation of its economy. The durability, divisibility, and intrinsic value of silver made it an ideal choice for currency, ensuring its role as a medium of exchange, store of value, and unit of account throughout the empire.

This progression illustrates how the initial use of silver coins by the Lydians laid the groundwork for future monetary systems, highlighting the enduring significance of silver in global economic history.

Silver Has Many Industrial Uses Which Drive Demand:

Silver is utilized across various major industries due to its exceptional properties such as high electrical and thermal conductivity, reflectivity, and antibacterial qualities. Key industries that use silver include:

Electronics and Electrical: Used for its excellent electrical conductivity in circuit boards, switches, TV screens, solar panels, and connectors. Also found in silver oxide batteries for devices like hearing aids and watches.

Jewelry and Silverware: Popular for jewelry and high-quality cutlery due to its aesthetic appeal and workability.

Photography: Used in traditional photographic films and papers, although its usage has declined with digital photography.

Medicine: Valued for its antimicrobial properties in wound dressings, creams, and coatings on medical devices.

Solar Energy: Essential in photovoltaic cells for solar panels due to its conductivity and reflectivity.

Automotive: Used in electrical contacts, conductors, and coatings for mirrors and windows.

Brazing and Soldering: Employed in high-temperature brazing and soldering materials.

Water Purification: Utilized for its ability to kill bacteria and other microorganisms.

Nanotechnology: Found in coatings, textiles, and medical products due to antimicrobial properties.

Catalysis: Used as a catalyst in producing chemicals like ethylene oxide and formaldehyde.

Unless the world unplugs, the demand for silver will constantly continue.

Featured Silver Assets:

Silver American Eagle

U.S. Mint

Silver British Britannia

Royal Great Britain Mint

Silver Canadian Maple Leaf

Royal Canadian Mint

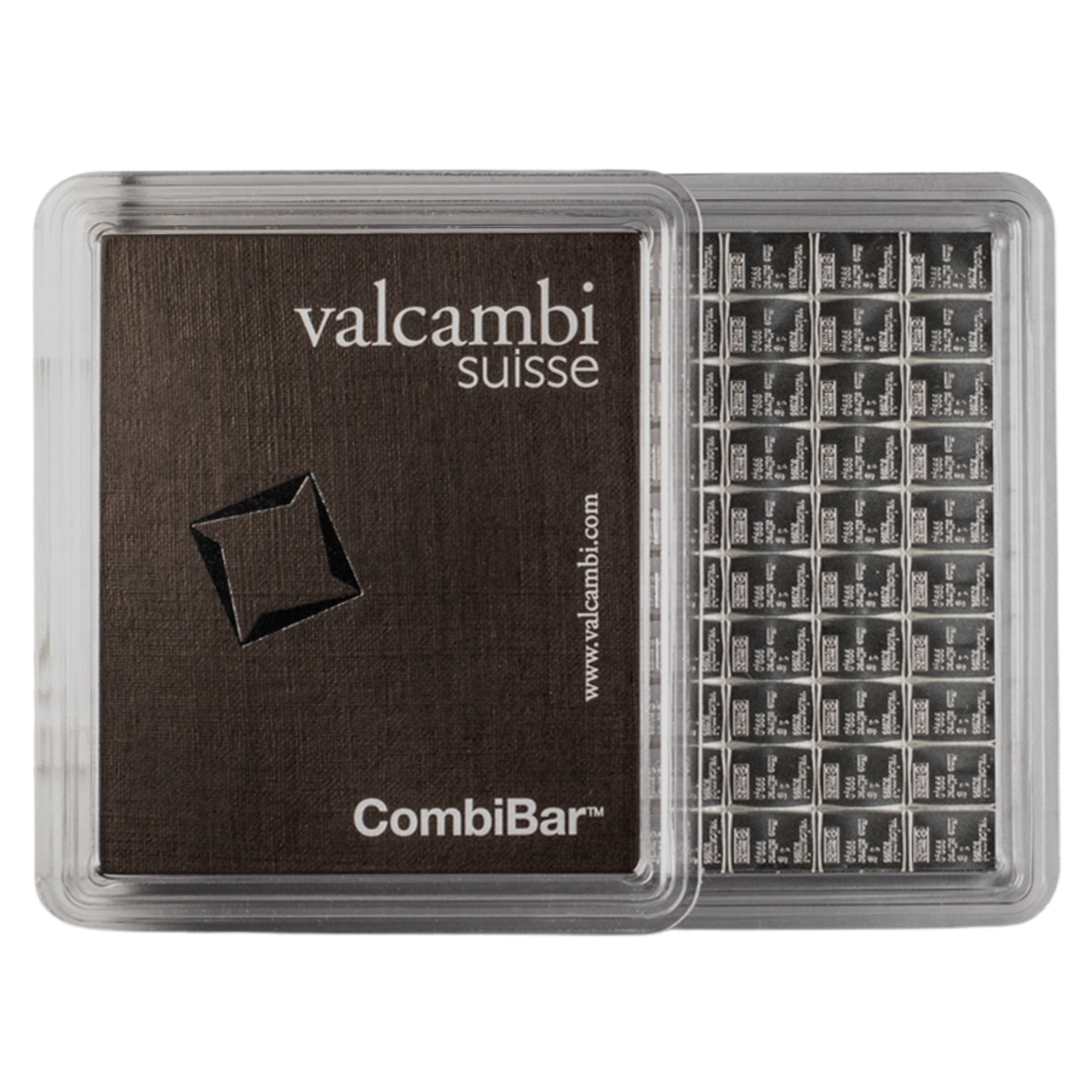

100g Valcambi Silver Bar

Suisse Mint