To recap the physical silver market for 2023, it experienced a modest 7% year-over-year increase. However, the market overall remained relatively flat, unable to surpass the $25 price resistance level. This was disappointing to many, especially given the strong physical market conditions for silver and the 20% rise in gold, which reached new record highs.

2023's Stagnation Can Be Attributed to Several Factors:

Global Sales: Sales of silver bars and coins decreased in 2023. This decline must be viewed against the substantial growth from 2020 to 2022. Reduced demand in Germany was due to added taxes, while in India, lower purchasing was due to record-high local prices. Conversely, the US saw healthy safe-haven buying due to the regional banking crisis.

Macroeconomic Environment: Despite a favorable environment for precious metals, gold has been the primary focus due to its clear monetary characteristics, greater acceptance as a safe haven for investors' portfolios, and significant year-over-year increases in buying by central banks as a reserve currency.

Institutional Influence: Unlike gold, silver is largely influenced by institutional investors who engage in speculation for profit due to its high volatility. Recently, interest has shifted towards tech stocks and cryptocurrencies. However, as these markets conclude their bull cycles, it is expected that silver will attract significantly more attention from institutional investors.

Industrial Demand: Even with robust industrial demand for silver, investor interest has been tempered by a sluggish Chinese economy.

Aboveground Inventories: High levels of aboveground inventories have been a significant challenge for silver. While current inventories appear sufficient, they are ultimately finite. These ample supplies have prevented any physical squeeze in the market, despite strong supply-demand dynamics. The global silver market's underlying health is evident in the significant physical deficit recorded last year, the second highest on record, surpassed only by 2022.

It is important to note that while silver is often expected to outperform gold in bullish markets, this does not occur every year within the larger bull market cycle. Although a significant price rise may not happen immediately, silver is likely to see substantial price gains in the future.

Silver's 2024 Outlook:

2024 marked a change in the tide as silver broke above the $25 price resistance and tested above $32. Several factors contribute to this shift:

Surge in Safe-Haven Demand: In 2024, silver's status as a safe-haven asset has soared dramatically. Amid heightened economic uncertainty and escalating global turbulence, conservative investors are increasingly seeking refuge in silver, driving its demand to unprecedented levels.

Speculative Inflows: Speculative inflows into silver increased rapidly with large new record highs in gold prices, driven by expectations of silver catching up.

Base Metal Prices: The rebound in base metal prices further boosted sentiment towards silver.

Industrial and Jewelry Demand: Silver’s industrial uses have strengthened in recent quarters, along with increased demand for silver in jewelry.

These are very bullish events for silver, confirming its upward trend, with new highs expected within the next couple of years or even sooner!

Enjoy a ZERO-cost retirement move with HGG + earn up to 10 years FREE IRA yearly fees

Featured Products for IRS-Approved Silver Assets:

Silver American Eagle

U.S. Mint

Silver British Britannia

Royal Great Britain Mint

Silver Canadian Maple Leaf

Royal Canadian Mint

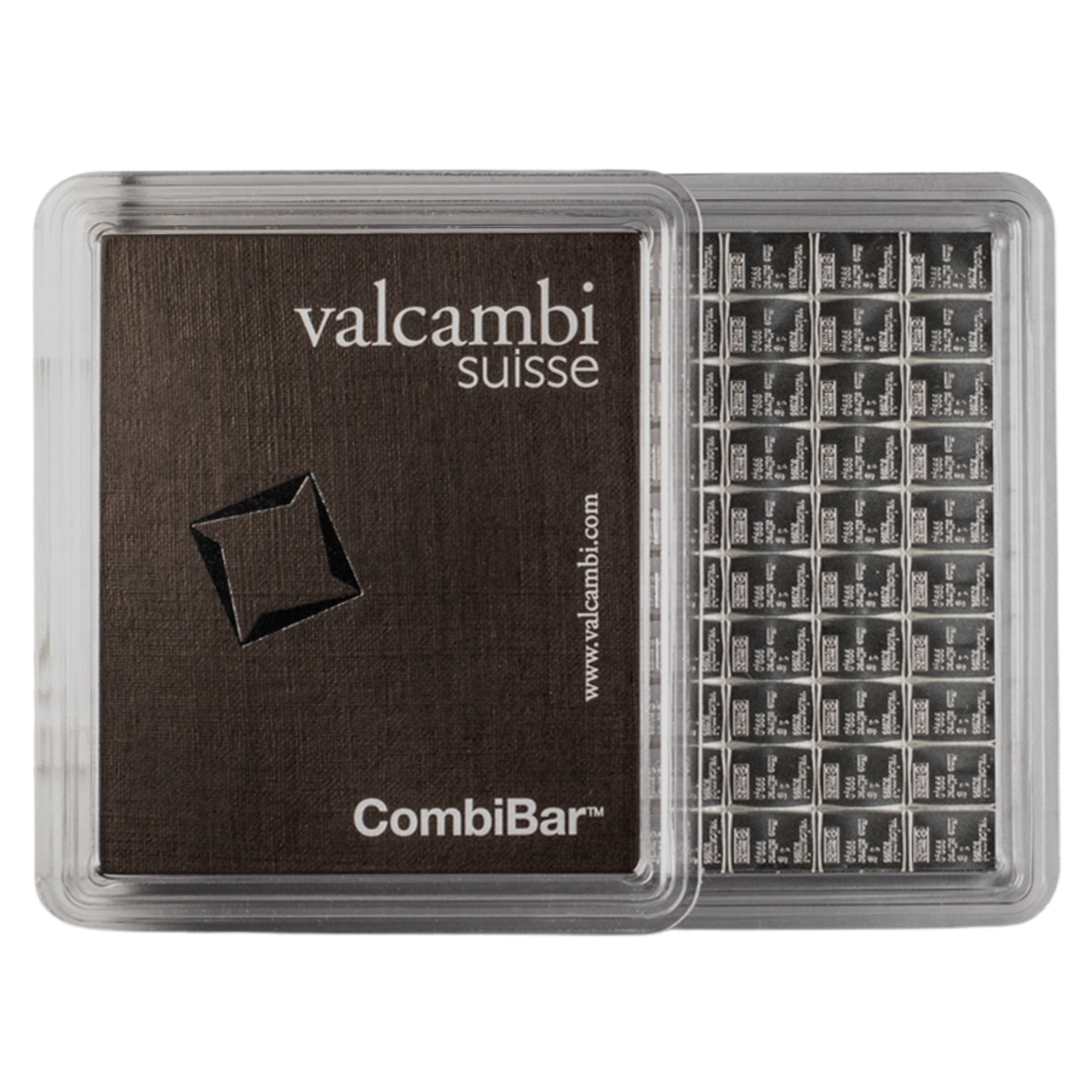

100g Valcambi Silver Bar

Suisse Mint

Why Harvard Gold Group?

America's #1 Conservative Gold Company

As seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The Christian Post, The New York Sun, and more — Harvard Gold Group (HGG) is trusted nationwide for exceptional service and unmatched value.

We hold an A rating with the BBB and maintain a flawless 5-star reputation across the board, with zero complaints. Since 2010, our co-owners have helped Americans move over $100 million into tangible gold and silver, whether for retirement accounts or secure direct delivery.

Clients benefit from free consultations and metals overviews, tax-free purchases for eligible accounts, free 2-day insured shipping, a best-pricing policy, and lifetime account care. Every customer has direct access to our experienced co-owners, ensuring your precious metals investment is secure, straightforward, and backed by over a decade of expertise — along with a straightforward buyback program that has no hassle or liquidation fees.

✔ Tax-Free & Penalty-Free: A Rollover or Transfer of your Retirement Account is almost always tax-free and penalty-free.

✔ Free Metals/Promos: Earn up to $15,000 in FREE Gold/Silver/Promos, on qualifying purchases.

✔ Free Retirement Account Rollover/Transfer: Zero cost to rollover/transfer/move retirement accounts or IRAs to a Gold/Silver IRA. *You can also earn up to 10 years of FREE IRA yearly fees*.

✔ Privacy: We protect your privacy and believe it is a commodity as valuable as time— you can't get it back. We do not sell your information to third parties.

✔ HGG Lifetime Account Care: Providing a dedicated account specialist and keeping you updated with market news and trends.

✔ Harvard BuyBack Program: Hassle-free buyback of HGG metals with no liquidation fees.

✔ Guaranteed Precious Metals: We only deal in government-issued coins and qualified branded bars.

✔ Free Shipping: Enjoy free shipping and insurance on orders over $10k. You can opt to have them delivered directly to your home, business, or an independent depository.

✔ What is Our Lowest Price Guarantee? We are committed to offering you the best value possible, with a comprehensive price-match policy.

✔ Customer Satisfaction: Harvard Gold Group is a 5-star rated company committed to maintaining exceptional customer service satisfaction.

✔ You work directly with the founders of HGG.