In its 10th annual Billionaire Ambitions Report for 2024, UBS highlights significant trends in the investment strategies of the world’s wealthiest individuals. Over the past decade, the total wealth of billionaires has skyrocketed by 121%, growing from $788.9 billion in 2015 to $2.4 trillion in 2024. The number of billionaires has similarly increased from 1,757 to 2,682, reflecting the ongoing expansion of global wealth. However, despite this remarkable growth, many billionaires are turning to a time-tested asset to protect and preserve their wealth: gold.

A Shift Toward Defensive Assets

One of the key findings from UBS’s report is a clear shift in how billionaires are thinking about wealth preservation. In response to global economic instability, rising geopolitical risks, and fears of market corrections, 40% of billionaires surveyed indicated they are planning to increase their gold holdings. In contrast, 27% of respondents expressed intentions to reduce their investments in hedge funds, signaling a move away from riskier assets.

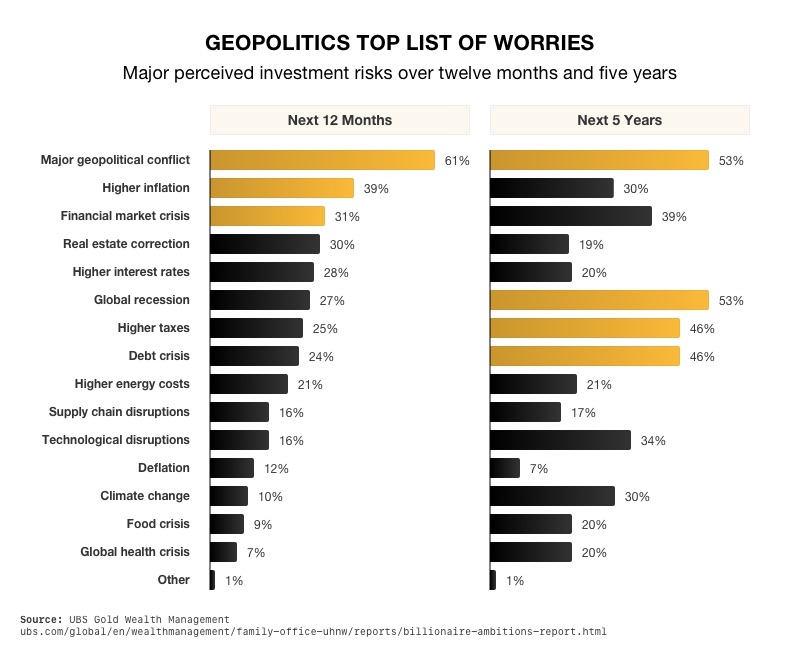

This pivot toward gold reflects broader concerns among the ultra-wealthy. Falling interest rates, concerns about overvalued equity markets, and the growing likelihood of a global recession have made many billionaires more cautious. Notably, more than half of those surveyed foresee a major geopolitical conflict negatively impacting their investment portfolios in the coming year. Inflation remains another major concern, but geopolitical instability, debt crises, and financial market volatility are now dominating their risk assessments.

Billionaires Speak Out on Gold's Safety

Several high-profile billionaires have publicly endorsed gold as a key component of a well-diversified investment strategy. Eric Sprott, founder of the Sprott Physical Gold Trust, has long been an advocate for gold as a hedge against economic uncertainty. "Gold and silver are essential investments for anyone seeking protection against currency devaluations and economic uncertainties," Sprott stated, emphasizing gold’s role in safeguarding wealth.

Similarly, Seth Klarman, founder of Baupost Group, and Jeffrey Gundlach, the "Bond King," have both touted gold’s enduring value. Klarman, renowned for his risk-management expertise, described gold as "a tangible asset that retains its intrinsic value, regardless of economic policies and financial crises." Gundlach, known for his outspoken criticism of central banks, argues that gold is one of the few assets "not manipulated by central bank policy."

Ray Dalio, the billionaire founder of Bridgewater Associates, has incorporated substantial gold holdings into his firm’s portfolio, noting, "If you don’t own gold, you don’t know history or economics." For these prominent investors, gold is not just a commodity; it's a safeguard against the unpredictable forces shaping global markets.

Gold’s Popularity Among Ultra-High-Net-Worth Individuals

The appeal of gold extends beyond billionaires to other wealthy individuals, including those classified as ultra-high-net-worth individuals (UHNWIs)—those with more than $30 million in assets. On average, UHNWIs allocate about 2% of their net worth to gold, using it as a defensive tool against inflation, currency fluctuations, and geopolitical risks.

The interest in gold is not limited to the ultra-wealthy. A recent survey found that among investors with at least $250,000 in assets, the percentage owning gold has surged, nearly doubling from 20% in early 2023 to 38% by mid-2024. For many of these investors, physical gold, such as bullion, has become a cornerstone of their portfolio. The average allocation to gold among these investors increased from 14% to 21%, with many citing stock market volatility and inflation as key drivers behind their decision to invest in precious metals.

The Rising Price of Gold

Gold’s popularity as a safe haven is reflected in its surging price. Since the beginning of 2024, gold has risen by nearly 26%, outpacing the broader stock market, including the S&P 500. A key catalyst for this rise has been the resumption of gold purchases by China’s central bank, after a seven-month hiatus. Analysts suggest that China has been quietly acquiring gold during this period, likely to diversify its foreign reserves away from the U.S. dollar and protect against currency depreciation amid ongoing economic crises.

Geopolitical instability, particularly in regions like the Middle East, has further fueled demand for gold. Investors seeking to shield their wealth from the potential fallout of conflicts have flocked to gold as a stable, non-correlated asset. Additionally, expectations that the Federal Reserve may cut interest rates further this year could drive even more investors to gold, as lower rates make non-interest-bearing assets like gold more attractive.

Warning of an Impending Market Collapse

The rising interest in gold among billionaires is also linked to growing concerns about the stability of financial markets. Renowned investors like Jeremy Grantham and Mark Spitznagel have issued stark warnings about the potential for a major market crash. Grantham, who famously predicted the dot-com bubble and the 2008 financial crisis, described the current market as “the most vulnerable market there has ever been.” He cautioned that a crash could occur “without warning,” and urged investors to prepare for a sudden downturn.

Spitznagel, another respected investor, echoed these concerns, suggesting that the market is currently in a “Goldilocks phase,” where things appear perfect but are vulnerable to sudden collapse. He warned that the current "biggest market bubble in history" could eventually lead to a prolonged recession, which would further underscore the value of defensive assets like gold.

Conclusion: Gold as a Hedge Againist Uncertainty

As billionaires and wealthy individuals shift their strategies toward gold, it’s clear that the precious metal is becoming an essential hedge against economic and geopolitical uncertainty. From the ultra-wealthy to regular investors, many are recognizing the value of physical gold as a store of wealth in an increasingly volatile world.

Whether driven by inflation concerns, stock market volatility, or the looming threat of a global recession, gold’s appeal as a safe haven asset is undeniable. If you’re looking to safeguard your financial future, now may be the time to consider adding physical gold to your investment strategy. For those exploring ways to protect their retirement savings, a Gold IRA could be an ideal solution.

For more information on how gold can help preserve your wealth, feel free to reach out at 844-977-4653 today.

References:

UBS 2024 Billionaire Ambitions Report

https://www.ubs.com/global/en/wealthmanagement/family-office-uhnw/reports/billionaire-ambitions-report.html

https://www.goldmarket.fr/en/top-10-billionaire-gold-owners/

https://finance.yahoo.com/news/much-ultra-wealthy-really-investing-190013474.html

https://www.investopedia.com/more-wealthy-investors-are-adding-gold-to-their-portfolios-heres-why-8747191

https://www.benzinga.com/markets/24/10/41145356/billionaire-who-predicted-2008-crash-and-dot-com-bubble-calls-the-current-economy-the-most-vulnerabl

https://finance.yahoo.com/news/billionaire-investor-predicted-2000-2008-000019851.html

Story by Harvard Gold Group