- Silver can and will hit $50 an Ounce.

- If silver trades above its secular breakout level of $28.80 by August 19th, 2024, silver might reach $50 still in 2024.

- This article provides insights into the conditions for silver to hit $50. In sum, we expect the big silver run to start in 2024 and move to $50 in two phases, reaching either late 2024 or mid-2025.

Silver can and will hit $50 an Ounce, the only question is WHEN. If silver trades above its secular breakout level $28.80 by August 19th, 2024, silver might reach $50 still in 2024.

This article provides insights into the conditions for silver to hit $50. In sum, we do expect the big silver run to start in 2024 and move to $50 in two phases which will be reached either late 2024 or mid-2025.

- The first target area is $34.70 – $37.70.

- The second target area is $48 – $50.

The quest to predict the timing of a price rally is a common intellectual challenge among investors seeking to better understand the silver market. Particularly, silver potential rally to $50 has captured attention due to its implications for traders and long-term investors alike.

Can the silver price hit $50 an Ounce?

Yes, the silver price rally can hit $50 an Ounce.

It was hard to believe when silver was trading at $24 which is when we initially published this article in January of 2024.

Update on July 14th, 2024 – The silver price, at the time of updating this blog post, is $31/oz. On May 17th, 2024 silver broke out; a few weeks later, it got back down to its breakout level. Since July 3d, 2024, silver confirmed a bounce from its breakout level which is $28.80. Our forecasted $50 target still stands; it might be postponed. We confirm: ‘silver will hit $50 and it will happen in 2024 if silver continues to trade above $28.80 by August 19th, 2024 (without touching $28.80).

Note that silver has a track record of powerful rallies. Consider the 1980 silver rally:

In part due to the actions of the Hunt brothers, the price for silver Good Delivery bars jumped from about $6 per troy ounce to a record high of $49.45 per troy ounce on January 18, 1980, representing an increase of 724%. The highest price of physical silver is hard to determine, but based on the price of common silver coins, it peaked at about $40/oz.

While a silver price rally in which silver will hit $50 may sound like a significant increase, the reality is that it’s neither exceptional nor extraordinary.

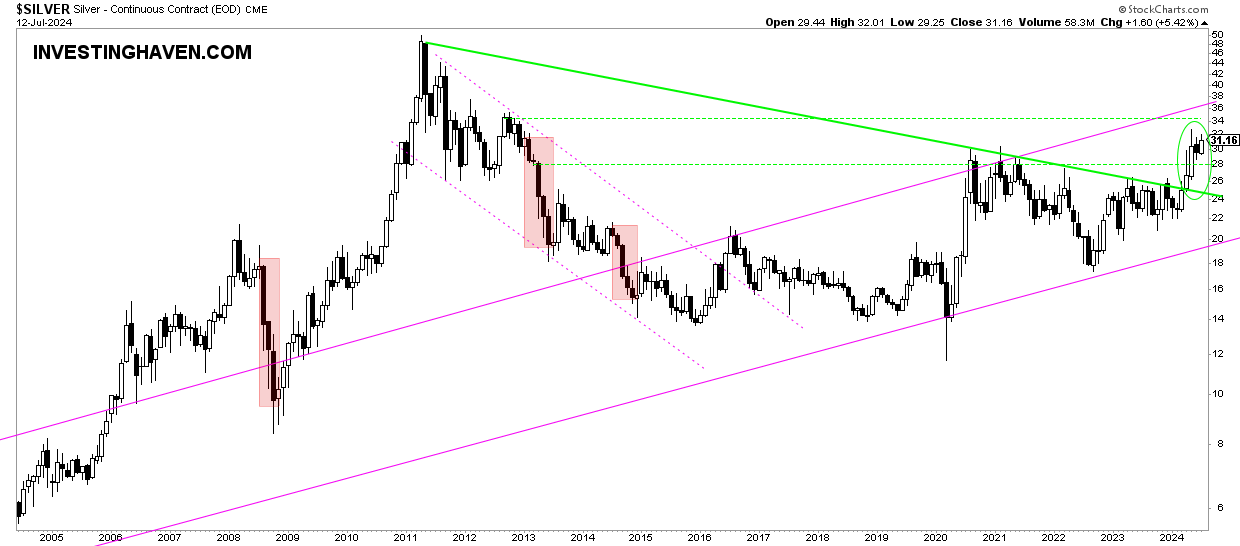

Silver breakout confirmed – silver can and will hit $50

May 17th, 2024, is a day for history books – the secular silver breakout happened on that day.

This is one of the must-see charts. The silver breakout on the weekly timeframe.

This is a secular breakout.

And it is powerful.

Silver is clearly headed to $50. The chart pattern will now create a new dynamic, and it will enable silver to hit $50 sooner rather than later.

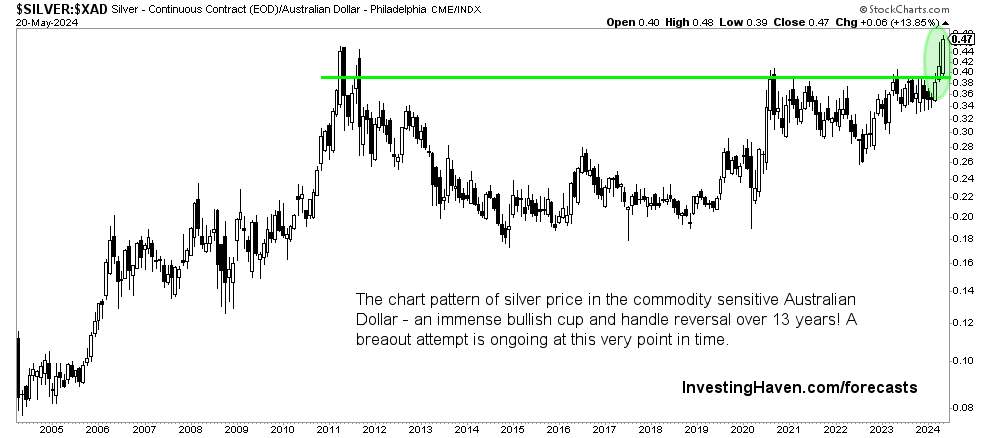

Silver – bull market confirmation by the AUD

The Australian Dollar is objectively confirming that silver can and will hit hit $50 an Ounce.

We explained this in great detail in several premium research notes to our precious metals followers (link to our premium research materials at the bottom of this article) – the Australian Dollar and silver are correlated.

Stated differently, the Australian Dollar has the ability to confirm silver’s bullish intention.

In a recently published article 5 Must-Read Insights For Silver Investors we wrote:

Silver’s bull market was objectively confirmed in the currency market.

It’s important to pay attention to intermarket dynamics. A strong and reliable bull market in any asset or stock is always objectively confirmed in another market.

In the case of silver, we noticed a confirmation in the Australian Dollar (AUD, also Aussie), the most commodity sensitive currency. When the Aussie goes up, it creates (‘confirms’) an environment that is favorable for commodities.

This is how it works:

- The silver to AUD ratio is an important intermarket measure.

- The ratio chart structure should be assessed.

- In case of bullish reversal, it implies that the Aussie is confirming silver’s bull market.

- The opposite is true as well.

Below is an up to date silver to AUD ratio chart. The chart pattern is ultra bullish. The AUD is objectively confirming the silver breakout. In a way, the AUD is giving green light for silver to hit $50 in the not too distant future.

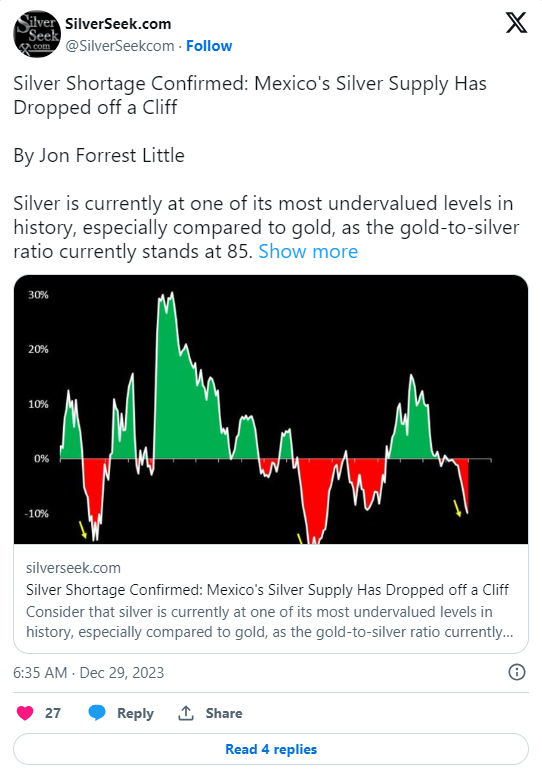

Silver supply shortage

In our analysis silver shortage, we stated:

The looming silver shortage stands out as a ticking time bomb. Despite COMEX silver price setting, the law of supply and demand will eventually prevail. As we approach a true silver supply shortage, the silver market’s true potential awaits, ready to reshape the price setting dynamics and elevate silver to new heights.

Indeed, the silver shortage is developing into a really serious problem. It seems to be getting worse with each passing month, as evidenced by recent data:

We believe that the physical market ultimately will take over control. Price discovery, orchestrated from within the silver futures market (COMEX) is not a sustainable price discovery dynamic.

Unless this physical silver market supply shortage resolves, which is very unlikely, it seems inevitable that the silver price will hit $50 an Ounce.

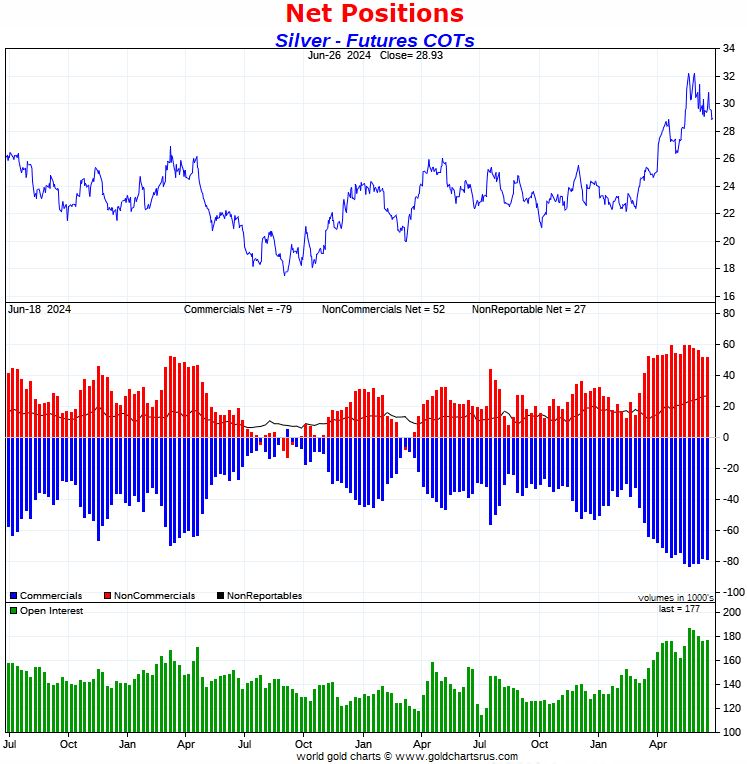

Silver COT analysis

One of the tools at the disposal of traders and analysts is the Commitment of Traders (COT) report, which presents a snapshot of market sentiment based on the positions of different trader categories.

Currently, on May 12th, 2024, the silver COT report paints a bearish-to-neural picture:

- net positions of commercials and non-commercials are bearish;

- commercials peaked in April, they are slightly decreasing their net short positions.

This suggests too much interest on the short side in the COMEX silver market. However, the readings are stretched, so some selling is required before silver can move higher. Alternatively, exceptional conditions like war or a supply squeeze can push silver higher, but only under really extreme conditions.

Update on July 14th, 2024 – The ‘really extreme conditions’ mentioned in the previous paragraph may be materializing with the most aggressive invasion of Russia in Ukraine, on May 10th, 2024 (source), combined with the rate cuts outlook (source).

For a detailed explanation of the mechanics of this chart, we suggest to follow our premium gold & silver market report.

On the flipside, obviously, comes the manipulation thesis. Silver is experiencing a supply deficit, for 3 years in a row, as explained above. How comes the price of silver is more than 50% below its ATH while all other commodities exceeded their 2007/2012 ATH?

Silver chart: the rally to $50 now officially started

Chart analysis often reveals patterns that provide valuable insights into future price movements.

The 12-month consolidation, since May 2023, hints at a bullish chart reversal which, if confirmed, should resolve to the upside in the current or next 3-month cycle (details about cycle analysis are shared every weekend in our premium gold & silver research service).

Such patterns are considered significant as they indicate a shift in sentiment from bearish to bullish or vice versa. If the pattern breaks to the upside, it will confirm a secular breakout attempt. This breakout might signify the beginning of a new bullish phase for silver, possibly setting the stage for the anticipated rally. Silver price chart: TradingView.

Moreover, the medium term oriented silver chart (above) should be complemented by the secular silver chart (below). As seen below, silver is now testing an epic secular breakout point. The falling trendline since 2011 is being tested for the 7th time in 4 years. This time might be different as the secular pattern nicely aligns with the cycle chart shown above.

Historical context

Silver’s history is marked by periods of significant price surges driven by various factors. Looking back, the metal has demonstrated its potential to deliver substantial gains within short timeframes. These historical instances underline the notion that silver is capable of sudden and powerful price movements. While history doesn’t repeat itself exactly, it does provide valuable insights into how external factors can propel silver prices higher.

Two stages of the silver price rally to $50 an Ounce

It’s important to understand that predicting a price rally to $50 doesn’t mean a single, uninterrupted climb. The journey could involve two distinct stages.

The initial stage might see silver moving toward $34.70, driven by a combination of technical and fundamental factors.

Once this stage is achieved, the path to $50 could follow. It will be supported by strengthening market sentiment, potential supply-demand imbalances, and external catalysts.

Conclusion

As investors eagerly await silver’s ascent to $50, a nuanced understanding of market dynamics and technical patterns is crucial.

Precise timing remains uncertain. However, a well-rounded perspective can be gained by:

- monitoring the silver COT report;

- analyzing price patterns;

- considering historical context;

- and acknowledging the potential for a two-stage rally can offer.

By incorporating these insights and analyses, investors can approach the silver market with a more informed outlook.

Story by InvestingHaven.com - Redacted shorter to keep to important points and bullet points added by HGG https://investinghaven.com/silver/when-price-silver-start-rally-50-usd/